[ad_1]

Information-Tech Analysis Team’s untouched blueprint highlights the transformative energy of Agile practices in addressing trade demanding situations and explores the way it can be enhanced visitor reports, foster innovation, and optimize operational potency. The company suggests within the pristine useful resource that by means of emphasizing visitor centricity, coordination with providers, integrated detail, innovation tradition, and a studying group mindset, banks can adapt, innovate, and excel within the fast moving virtual park.

TORONTO, July 16, 2024 /PRNewswire/ – A pristine trade useful resource from world analysis and advisory company Information-Tech Analysis Team highlights the demanding situations confronted by means of the banking sector in adapting to the fast moving virtual park, together with inflexible conventional processes, gradual innovation cycles, and fragmented communique between IT and industry gadgets. The company’s analysis findings at the matter, revealed in its untouched blueprint, Consider Agile for Banking, supplies insights on how Agile practices can deal with the tide stumbling blocks within the banking trade to foster a extra responsive and customer-centric way. Information-Tech advises that Agile methodologies can streamline operations, make stronger collaboration, and force steady development, which is very important for keeping up competitiveness within the fashionable banking sector.

“Agile has been around for over 20 years and has transformed software development and business models,” says David Tomljenovic, major analysis director at Information-Tech Analysis Team. “It has become an important methodology to help businesses within rapidly changing markets respond quickly with competitive products and services.”

Information-Tech’s analysis highlights the banking trade’s consistent force to bring pristine services to stay aggressive with a rising choice of marketplace contributors. The trade’s tide processes are inflexible and regularly in accordance with old-fashioned Waterfall building methodologies requiring in depth prematurely design. Moreover, many banks have advanced, hierarchical buildings with a tradition that doesn’t advertise ongoing communique, collaboration, or openness to modify. This underscores the desire for a shift to Agile methodologies to make stronger flexibility and responsiveness.

“Despite the overwhelming adoption of Agile across many industries, it has not been fully embraced in the retail banking industry,” explains Tomljenovic. “As Agile was adopted, industries that were highly regulated began to recognize that its principles did not always align with high levels of regulation. With its roots as a software development methodology, Agile has also struggled in environments where there are significant amounts of legacy technology and high complexity.”

The company identifies various alternatives for banks to enforce Agile and notice vital advantages. Month broad-based adoption could also be impractical, many banks are discovering luck by means of combining conventional Waterfall forms with Agile to make stronger visitor centricity.

To thrive in a all of a sudden evolving circumstance, the banking sector will have to triumph over a number of important demanding situations. Those demanding situations come with addressing real-time knowledge calls for for dynamic marketplace shifts, managing emerging working prices because of stringent regulatory necessities, and making an investment in powerful cybersecurity measures to give protection to towards more and more subtle ultimatum. Moreover, organizations will have to draw in and reserve professional ability in a extremely aggressive marketplace. Through strategically aligning IT projects with organizational objectives and fostering a tradition of adaptability and innovation, banks can successfully take on those demanding situations, important to enhanced and sustainable enlargement.

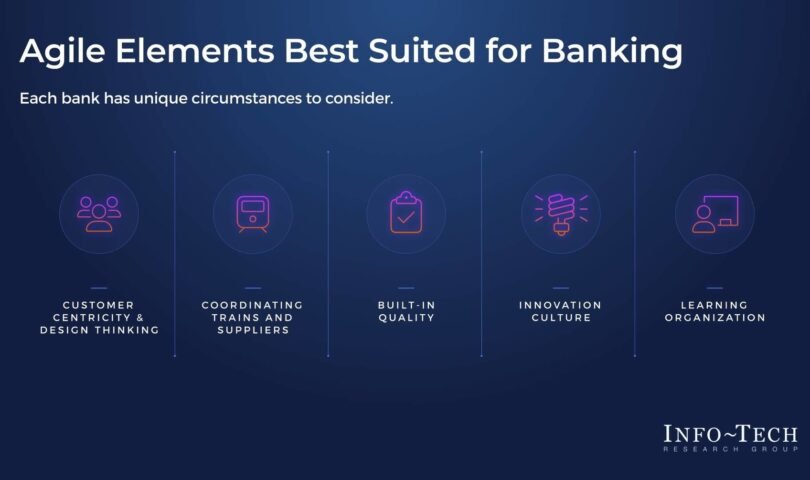

In its untouched blueprint, Information-Tech highlights 5 familiar Agile components perfect fitted to the banking trade:

- Buyer Centricity and Design Considering: Virtually each cupboard now prioritizes visitor centricity, contrasting with life practices the place merchandise focused at the cupboard itself. The be on one?s feet of neobanks and non-financial competition underscored the need for customer-focused methods. Agile methodologies force this shift, directing banks to allocate sources towards improving visitor reports, reflecting a elementary transition from inside to outward-focused operations.

- Coordinating Trains and Providers: Fashionable banking calls for complete gadget evaluations ahead of implementation because of complexity. Providers are a very powerful for integrating AI and gadget studying, as maximum banks can’t do that rejected. Upgrading infrastructure to incorporate composable techniques, AI, and fintech is very important for banks to stick aggressive and combine complex functions.

- Integrated Component: In banking, strict regulatory, felony, safety, and privateness necessities necessitate compliance from product inception. Banks emphasize prematurely making plans, integrated detail ideas, and lengthening those ideas to non-essential gardens like visitor engagement to assure compliance, mitigate reputational dangers, and ship customer-centric merchandise from the beginning.

- Innovation Tradition: Conventional banking forms possibility industry diminish, making innovation a very powerful. Encouraging staff to innovate, as they have interaction without delay with shoppers and processes, must be a concern. This inside innovation can govern to pristine merchandise, diminished prices, and better visitor delight. Through tying innovation to express industry results, banks can make stronger automation, undertake pristine applied sciences, and building up marketplace agility. On the other hand, innovation must be useful and no longer pursued simply for its personal sake.

- Studying Group: The banking sector is present process a vital transformation, requiring pristine abilities and a studying mindset to navigate converting marketplace situations. T-shaped staff, with liberality and deep experience, are key property for banks in flux. Information-Tech advises that by means of embracing team-based paintings, particularly via cross-functional groups, banks can abruptly adapt by means of selling wisdom sharing, creating flexible ability, and fostering a tradition of constant studying.

Information-Tech’s complete blueprint explains how a strategic shift can permit banks to conquer conventional limitations, reply extra abruptly to marketplace adjustments, and ship superb visitor reports. In keeping with the company’s insights, embracing Agile isn’t just about adopting a pristine method; it’s about fostering a tradition of adaptability and resilience. This way is a very powerful for staying aggressive and reaching long-term luck in an more and more dynamic and significant trade.

For unique and well timed observation from David Tomljenovic, knowledgeable within the banking trade, and get admission to to your entire Consider Agile for Banking blueprint, please touch [email protected].

Information-Tech LIVE 2024

Registration is now seen for Info-Tech Research Group’s annual IT conference, Info-Tech LIVE 2024, taking playground September 17 to 19, 2024, on the iconic Bellagio in Las Vegas. This premier tournament deals reporters, podcasters, and media influencers get admission to to unique content material, the untouched IT analysis and tendencies, and the chance to interview trade professionals, analysts, and audio system. To use for media passes to wait the development or acquire get admission to to analyze and skilled insights on trending subjects, please touch [email protected].

About Information-Tech Analysis Team

Info-Tech Research Group is among the international’s important analysis and advisory companies, proudly serving over 30,000 IT and HR pros. The corporate produces independent, extremely related analysis and offers advisory services and products to support leaders produce strategic, well timed, and well-informed choices. For almost 30 years, Information-Tech has partnered intently with groups to grant them with the whole thing they want, from actionable equipment to analyst steering, making sure they ship measurable effects for his or her organizations.

To be informed extra about Information-Tech’s categories, talk over with McLean & Company for HR analysis and advisory services and products and SoftwareReviews for instrument purchasing insights.

Media pros can sign up for unrestricted get admission to to analyze throughout IT, HR, and instrument and loads of trade analysts throughout the company’s Media Insiders program. To achieve get admission to, touch [email protected].

For details about Information-Tech Analysis Team or to get admission to the untouched analysis, talk over with infotech.com and attach by the use of LinkedIn and X.

SOURCE Information-Tech Analysis Team

[ad_2]

Source link