[ad_1]

|

This let fall must be learn with the Corporate’s Monetary Statements and Control Dialogue & Research (“MD&A”), to be had at www.tasekomines.com and filed on www.sedarplus.com. Aside from the place in a different way famous, all forex quantities are mentioned in Canadian bucks. In March 2024 Taseko got the difference 12.5% pastime and now owns 100% of the Gibraltar Mine, situated north of the Town of Williams Pool in south-central British Columbia. Manufacturing and gross sales volumes mentioned on this let fall are on a 100% foundation except in a different way indicated. |

VANCOUVER, BC, July 31, 2024 /PRNewswire/ – Taseko Mines Restricted (TSX: TKO) (NYSE American: TGB) (LSE: TKO) (“Taseko” or the “Company”) studies 2d quarter 2024 Adjusted EBITDA* of $71 million and Income from mining operations ahead of depletion and amortization* of $77 million. 2d quarter income benefited from a $26 million insurance coverage cure homogeneous to mill upkeep that had been finished in January. Revenues for the second one quarter had been $138 million. A web lack of $11 million ($0.04 loss in step with proportion) used to be recorded for the quarter and altered web source of revenue used to be $31 million ($0.10 in step with proportion).

Gibraltar produced 20 million kilos of copper and 185 thousand kilos of molybdenum in the second one quarter, as in the past disclosed. Manufacturing used to be impacted via deliberate downtime for the in-pit crusher relocation and alternative repairs, and an 18-day mine shutdown for a labour accident. Mill throughput within the quarter used to be 5.7 million lots, processing a mean grade of 0.23% copper. Copper medications within the quarter averaged 78%, not up to earlier quarters because of interruptions to running month in each concentrators. Overall running prices (C1)* for the quarter had been US$2.99 in step with pound of copper produced, upper than contemporary quarters principally because of decrease manufacturing ranges. The in-pit crusher relocation, a undertaking in building for almost two years, used to be finished in the second one quarter. Conveyor and electric secured ins had been executed via mid-July and the fresh machine is now operating at complete capability.

Stuart McDonald, President and CEO of Taseko, commented, “This was our first full quarter with 100% ownership of Gibraltar and despite the operational disruptions, the mine’s financial performance was quite strong as we generated $35 million of operating cashflow. With all of the major project and mill maintenance work now completed at Gibraltar, we’re looking forward to stronger copper production and cashflow generation in the second half.”

Development actions on the Florence Copper undertaking endured to ramp up in the second one quarter and there are over 200 contractors now onsite. Concrete foundations had been poured for the SX/EW plant, tank farms and alternative key parts of the plant web page. At the wellfield, 18 manufacturing wells had been finished to the top of June, in form with the agenda, and building of the pipeline hall is definitely complicated. The primary evaporation pool, which has been introduced forward within the agenda to grant larger H2O control flexibility can be absolutely coated and finished within the then few weeks.

Mr. McDonald added, “We’re pleased with the initial construction progress at Florence as all key activities are advancing on schedule. We’ve also had good success in recruiting key management and technical roles for the commercial operation and now have nearly half of the 170 permanent positions filled. Many of these positions have been filled by local Arizonans and there is excitement about participating in the development of America’s next copper mine. The project remains on schedule for first copper production in the fourth quarter 2025.”

*Non-GAAP efficiency measure. See finish of stories let fall

2d Quarter Assessment

- Income from mining operations ahead of depletion, amortization and non-recurring pieces* used to be $76.9 million, Adjusted EBITDA* used to be $70.8 million, and Adjusted web source of revenue* used to be $30.5 million ($0.10 in step with proportion);

- 2d quarter money tide from operations used to be $34.7 million and web loss used to be $11.0 million ($0.04 loss in step with proportion) for the quarter;

- Gibraltar produced 20.2 million kilos of copper for the quarter. Moderate head grades had been 0.23% and copper medications had been 78% for the quarter;

- Gibraltar bought 22.6 million kilos of copper within the quarter at a mean learned copper fee of US$4.49 in step with pound;

- Overall running prices (C1)* for the quarter had been US$2.99 in step with pound produced;

- On June 1, 2024, operations on the Gibraltar mine had been suspended for 18 days because of accident motion via its unionized personnel. The mine used to be put into transient help and upkeep with handiest crucial team of workers running and keeping up essential methods all the way through the accident. Operations at Gibraltar resumed on June 19 next the ratification of a fresh promise via union contributors;

- Throughout the quarter, a complete of five.7 million lots had been milled. Throughput used to be impacted via each the labour accident and deliberate downtime in Concentrator #1 for the relocation of the principle crusher and upkeep;

- Throughout the quarter, the Corporate finalized an insurance coverage declare for estate harm to Concentrator #2 and industry interruption for the related manufacturing affect in 2023 and January 2024. An spare insurance coverage cure of $26.3 million used to be recorded in the second one quarter, and proceeds are anticipated to be won within the 3rd quarter;

- Development of the industrial manufacturing facility at Florence is advancing with contemporary actions considering wellfield drilling, procedure pool building and civil works together with pouring of concrete foundations;

- On April 23, 2024, the Corporate finished an providing of US$500 million combination major quantity of 8.25% Senior Tied Notes due Might 1, 2030. Nearly all of the proceeds had been old to redeem the phenomenal US$400 million 7% Senior Tied Notes due on February 15, 2026. The difference proceeds, web of transaction prices, name top class and amassed pastime, had been roughly $110 million and are to be had to treasure capital tasks, together with building at Florence Copper; and

- The Corporate had a money steadiness of $199 million at June 30, 2024 and has roughly $308 million of to be had liquidity together with its undrawn US$80 million revolving credit score facility.

*Non-GAAP efficiency measure. See finish of stories let fall

Highlights

|

Working Knowledge (Gibraltar – 100% foundation) |

3 months ended June 30, |

Six months ended June 30, |

||||

|

2024 |

2023 |

Alternate |

2024 |

2023 |

Alternate |

|

|

Heaps mined (tens of millions) |

18.4 |

23.4 |

(5.0) |

41.2 |

47.5 |

(6.3) |

|

Heaps milled (tens of millions) |

5.7 |

7.2 |

(1.5) |

13.4 |

14.3 |

(0.9) |

|

Manufacturing (million kilos Cu) |

20.2 |

28.2 |

(8.0) |

49.9 |

53.1 |

(3.2) |

|

Gross sales (million kilos Cu) |

22.6 |

26.1 |

(3.5) |

54.3 |

52.7 |

1.6 |

|

Monetary Knowledge |

3 months ended June 30, |

Six months ended June 30, |

||||

|

(Cdn$ in hundreds, apart from for in step with proportion quantities) |

2024 |

2023 |

Alternate |

2024 |

2023 |

Alternate |

|

Revenues |

137,730 |

111,924 |

25,806 |

284,677 |

227,443 |

57,234 |

|

Money flows supplied via operations |

34,711 |

33,269 |

1,442 |

94,285 |

61,268 |

33,017 |

|

Internet (loss) source of revenue (GAAP) |

(10,953) |

9,991 |

(20,944) |

7,943 |

43,779 |

(35,836) |

|

According to proportion – unadorned (“EPS”) |

(0.04) |

0.03 |

(0.07) |

0.03 |

0.15 |

(0.12) |

|

Income from mining operations ahead of |

76,928 |

27,664 |

49,264 |

129,725 |

68,803 |

60,922 |

|

Adjusted EBITDA* |

70,777 |

22,218 |

48,559 |

120,700 |

58,277 |

62,423 |

|

Adjusted web source of revenue (loss)* |

30,503 |

(4,376) |

34,879 |

38,231 |

712 |

37,519 |

|

According to proportion – unadorned (“adjusted EPS”)* |

0.10 |

(0.02) |

0.12 |

0.13 |

– |

0.13 |

Efficient as of March 25, 2024 the Corporate higher its possession in Gibraltar from 87.5% to 100%. Because of this, the monetary effects reported on this MD&A come with 100% of Gibraltar source of revenue and bills for the length March 25, 2024 to June 30, 2024 (87.5% for the length March 16, 2023 to March 24, 2024, and 75% previous to March 15, 2023). For more info at the Corporate’s acquisition of Cariboo, please please see the Monetary Statements – Notice 3.

The Corporate finalized the accounting for the purchase of its preliminary 50% pastime in Cariboo from Sojitz and the homogeneous 12.5% pastime in Gibraltar within the fourth quarter of 2023. According with the accounting requirements for industry mixtures, the related monetary statements as of June 30, 2023 and for the 3 and 6 months nearest ended had been revised to replicate the adjustments in finalizing the dignity paid and the allocation of the acquisition fee to the belongings and liabilities got.

*Non-GAAP efficiency measure. See finish of stories let fall

Assessment of Operations

Gibraltar mine

|

Working knowledge (100% foundation) |

Q2 2024 |

Q1 2024 |

This fall 2023 |

Q3 2023 |

Q2 2023 |

|

Heaps mined (tens of millions) |

18.4 |

22.8 |

24.1 |

16.5 |

23.4 |

|

Heaps milled (tens of millions) |

5.7 |

7.7 |

7.6 |

8.0 |

7.2 |

|

Strip ratio |

1.6 |

1.7 |

1.5 |

0.4 |

1.5 |

|

Website running value in step with ton milled (Cdn$)* |

$13.93 |

$11.73 |

$9.72 |

$12.39 |

$13.17 |

|

Copper listen |

|||||

|

Head grade (%) |

0.23 |

0.24 |

0.27 |

0.26 |

0.24 |

|

Copper cure (%) |

77.7 |

79.0 |

82.2 |

85.0 |

81.9 |

|

Manufacturing (million kilos Cu) |

20.2 |

29.7 |

34.2 |

35.4 |

28.2 |

|

Gross sales (million kilos Cu) |

22.6 |

31.7 |

35.9 |

32.1 |

26.1 |

|

Stock (million kilos Cu) |

2.3 |

4.9 |

6.9 |

8.8 |

5.6 |

|

Molybdenum listen |

|||||

|

Manufacturing (thousand kilos Mo) |

185 |

247 |

369 |

369 |

230 |

|

Gross sales (thousand kilos Mo) |

221 |

258 |

364 |

370 |

231 |

|

According to unit knowledge (US$ in step with pound produced)* |

|||||

|

Website running prices* |

$2.88 |

$2.21 |

$1.59 |

$2.10 |

$2.43 |

|

Spinoff credit* |

(0.26) |

(0.17) |

(0.13) |

(0.23) |

(0.13) |

|

Website running prices, web of spinoff credit* |

$2.62 |

$2.04 |

$1.46 |

$1.87 |

$2.30 |

|

Off-property prices |

0.37 |

0.42 |

0.45 |

0.33 |

0.36 |

|

Overall running prices (C1)* |

$2.99 |

$2.46 |

$1.91 |

$2.20 |

$2.66 |

Assessment of Operations

2d Quarter Assessment

Gibraltar produced 20.2 million kilos of copper for the quarter. Copper manufacturing and mill throughput within the quarter had been impacted via a accident in June 2024 and deliberate downtime in Concentrator #1 for the relocation of the in-pit crusher and alternative concurrent repairs.

On June 1, 2024, operations on the mine had been suspended for 18 days because of accident motion via Gibraltar’s unionized personnel accident. Throughout this era all mining and milling operations had been close ailing and handiest crucial team of workers remained on web page to perform and uphold essential methods. Operations resumed on June 19, next the ratification of a fresh promise via union contributors.

Copper head grades of 0.23% had been in form with control expectancies and the mine plan. Copper medications in the second one quarter had been 78%, not up to the hot quarters because of higher milling of partly oxidized ore from the Connector pit and variable mill running situations all the way through the accident and upkeep actions.

Operations Research – Persisted

A complete of 18.4 million lots had been mined in the second one quarter, not up to earlier quarters because of the labour disruption. Stripping endured within the Connector pit and ore let fall will transition from the Gibraltar pit to the Connector pit within the coming months. A complete of one.5 million lots of oxide ore from the higher benches of the Connector pit had been additionally added to the heap leach pads within the length.

Overall web page prices* at Gibraltar of $90.5 million (which incorporates capitalized stripping of $10.7 million) used to be decrease in comparison to the former quarter because of the accident in June. A complete of $2.5 million help and upkeep prices had been incurred all the way through the accident which aren’t integrated in overall web page prices or value of gross sales.

Throughout the six months ended June 30, 2024, the Corporate incurred overall prices of $9.7 million in terms of the principle crusher relocation undertaking for Concentrator #1. Direct prices for the bodily walk of the crusher of $7.9 million had been integrated within the remark of source of revenue (loss).

Molybdenum manufacturing used to be 185 thousand kilos in the second one quarter and manufacturing used to be impacted via mill availability. At a mean molybdenum fee of US$21.79 in step with pound, molybdenum generated a spinoff credit score in step with pound of copper produced of US$0.26 in the second one quarter.

Off-property prices in step with pound produced* had been US$0.37 for the second one quarter and in addition mirrored upper copper gross sales volumes relative to manufacturing volumes in comparison to the prior quarter.

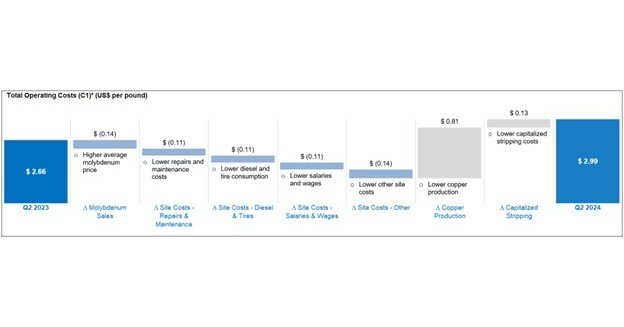

Overall running prices in step with pound produced (C1)* used to be US$2.99 for the quarter, in comparison to US$2.66 within the prior yr quarter as proven within the bridge graph underneath with the extra considerably attributed to the decrease copper manufacturing within the quarter:

Gibraltar Outlook

With the foremost undertaking and upkeep paintings in each concentrators now finished, manufacturing in the second one part of 2024 is predicted to be more potent than the primary part of 2024. An up to date mine plan and mill throughput alternatives are being evaluated to recuperate one of the most manufacturing that used to be misplaced all the way through the accident. Copper manufacturing for the yr is predicted to be within the dimension of 110 to 115 million kilos, in comparison to latest steering of roughly 115 million kilos.

The Gibraltar pit endured to be the primary supply of mill feed in the second one quarter and mining of ore is now transitioning into the Connector pit, which would be the number one supply of mill feed in the second one part of the yr. Extra oxide ore from Connector pit is predicted to be added to the heap leach pads this yr. Refurbishment of Gibraltar’s SX/EW plant, which has been lazy since 2015, will start after this yr and control is making plans to restart the ability in 2025.

*Non-GAAP efficiency measure. See finish of stories let fall

Gibraltar Outlook – Persisted

Within the quarter, the Corporate has tendered Gibraltar listen to diverse shoppers for the remains of 2024 and for vital tonnages in 2025 and 2026. In 2023, Remedy and Refining Prices (“TCRCs”) accounted for roughly US$0.17 in step with pound of off-property prices. With those lately awarded offtake pledges, the Corporate expects off-property prices to decrease to US$0.05 in step with pound or much less over the then two and a part years because of those constant, decrease TCRCs at the sale of its copper listen.

The Corporate has a prudent hedging program in park to offer protection to a minimal copper fee all the way through the Florence building length. These days, the Corporate has copper collar pledges that retain a minimal copper fee of US$3.75 in step with pound for 42 million kilos of copper protecting the second one part of 2024, and copper collar pledges that retain a minimal copper fee of US$4.00 in step with pound for 108 million kilos of copper for 2025. The copper collar pledges even have ceiling costs between US$5.00 and US$5.40 in step with pound (please see the division “Hedging Strategy” for main points).

Florence Copper

The Corporate has the entire key allows in park for the industrial manufacturing facility at Florence Copper and building has commenced. All of the primary SX/EW plant parts are on web page and former paintings on colorful engineering and procurement of long-lead pieces has de-risked the development agenda. First copper manufacturing is predicted within the fourth quarter of 2025.

The Corporate has a technical file entitled “NI 43-101 Technical Report Florence Copper Project, Pinal County, Arizona” dated March 30, 2023 (the “2023 Technical Report”) on SEDAR+. The 2023 Technical Document used to be ready in keeping with NI 43-101 and integrated the result of testwork from the Manufacturing Take a look at Facility (“PTF”) in addition to up to date capital and running prices (Q3 2022 foundation) for the industrial manufacturing facility.

Challenge highlights in response to the 2023 Technical Document:

- Internet provide price of US$930 million (at $US 3.75 copper fee, 8% after-tax bargain charge)

- Interior charge of go back of 47% (after-tax)

- Payback length of two.6 years

- Working prices (C1) of US$1.11 in step with pound of copper

- Annual manufacturing capability of 85 million kilos of LME grade A cathode copper

- 22 yr mine presen

- Overall presen of mine manufacturing of one.5 billion kilos of copper

- Too much preliminary capital value of US$232 million (Q3 2022 foundation)

Development actions in the second one quarter of 2024 have considering wellfield drilling, web page arrangements and earthworks for the industrial wellfield and plant segment together with the excavation of procedure ponds and urban base paintings for the plant, and the hiring of spare staff for the development and operations groups.

Drilling of the industrial facility wellfield commenced in February and two drills operated all the way through the second one quarter, with a 3rd drill mobilized in July. As of the top of June, a complete of 18 manufacturing wells were drilled which is in form with the deliberate building agenda.

The Corporate has a fixed-price word with the overall contractor for building of the SX/EW plant and related floor infrastructure.

Florence Copper – Persisted

Florence Copper Quarterly Capital Spend

|

3 months ended |

Six months ended |

|

|

(US$ in hundreds) |

June 30, 2024 |

June 30, 2024 |

|

Website and PTF operations |

4,314 |

8,559 |

|

Business facility building prices |

36,850 |

54,848 |

|

Alternative capital prices |

7,053 |

22,762 |

|

Overall Florence undertaking expenditures |

48,217 |

86,169 |

The estimated difference capital prices within the 2023 Technical Document for building of the industrial facility used to be US$232 million, of which US$36.9 million has been incurred in the second one quarter of 2024 and US$54.8 million has been incurred for the six months ended June 30, 2024. Alternative capital prices of US$22.8 million come with ultimate bills for supply of long-lead apparatus that used to be ordered in 2022, and in order ahead the development of an evaporation pool to grant spare H2O control flexibility.

The Corporate has closed a number of Florence undertaking stage financings to treasure preliminary business facility building prices. On April 26th, the Corporate won the second one storagefacility of US$10 million from the US$50 million copper tide transaction with Mitsui & Co. (U.S.A.) Inc. (“Mitsui”). The 3rd storagefacility used to be won in July and the difference quantities of US$20 million must be won in October 2024 and January 2025.

The Corporate considers that the development of Florence Copper is now absolutely funded, and difference undertaking prices are anticipated to be funded with the Corporate’s to be had liquidity, difference instalments from Mitsui, and cashflow from its 100% possession pastime in Gibraltar. The Corporate additionally has in park an undrawn revolving credit score facility for US$80 million.

Lengthy-term Expansion Technique

Taseko’s technique has been to develop the Corporate via obtaining and creating a pipeline of tasks considering copper in North The united states. We proceed to consider this may increasingly generate long-term returns for shareholders. Our alternative building tasks are situated in British Columbia, Canada.

Yellowhead Copper Challenge

Yellowhead Mining Inc. (“Yellowhead”) has an 817 million tonnes keep and a 25-year mine presen with a pre-tax web provide price of $1.3 billion at an 8% bargain charge the use of a US$3.10 in step with pound copper fee founded at the Corporate’s 2020 NI 43-101 technical file. Capital prices of the undertaking had been estimated at $1.3 billion over a 2-year building length. Throughout the primary 5 years of operation, the copper similar grade will reasonable 0.35% generating a mean of 200 million kilos of copper in step with yr at a mean C1* value, web of spinoff credit score, of US$1.67 in step with pound of copper produced. The Yellowhead copper undertaking incorporates decent treasured steel by-products with 440,000 oz of gold and 19 million oz of silver manufacturing over the presen of mine.

Lengthy-term Expansion Technique – Persisted

The Corporate is making ready to journey into the environmental overview procedure and has lately opened a undertaking place of work to help ongoing engagement with native communities together with First International locations. The Corporate could also be carrying out a web page investigation grassland program this yr, and accumulating baseline knowledge and modeling which can be old to help the environmental overview and allowing of the undertaking.

Pristine Prosperity Gold-Copper Challenge

In past due 2019, the Tŝilhqot’in Family, as represented via Tŝilhqot’in Nationwide Govt, and Taseko Mines Restricted entered right into a hidden discussion, with the involvement of the Province of British Columbia, looking for a long-term solution of the war relating to Taseko’s proposed copper-gold mine in the past referred to as Pristine Prosperity, acknowledging Taseko’s business pursuits and the Tŝilhqot’in Family’s opposition to the undertaking.

This discussion has been supported via the events’ promise, starting December 2019, to a line of standstill promises on sure remarkable litigation and regulatory issues in terms of Taseko’s tenures and the segment within the neighborhood of Teẑtan Biny (Fish Pool).

The discussion procedure has made significant go in contemporary months however isn’t whole. The Tŝilhqot’in Family and Taseko recognize the optimistic nature of discussions, and the chance to conclude a long-term and mutually applicable solution of the war that still makes an impressive contribution to the objectives of reconciliation in Canada.

In March 2024, Tŝilhqot’in and Taseko officially reinstated the standstill promise for a last expression, with the objective of finalizing a solution ahead of the top of this yr.

Aley Niobium Challenge

Environmental tracking and product advertising and marketing tasks at the Aley niobium undertaking proceed. The converter pilot check is ongoing and is offering spare procedure knowledge to help the design of the industrial procedure amenities and can grant ultimate product samples for advertising and marketing functions. The Corporate has additionally initiated a scoping find out about to research the prospective manufacturing of niobium oxide at Aley to offer the rising marketplace for niobium-based batteries.

Annual Sustainability Document

In June 2024, the Corporate printed its annual Sustainability Document, titled H2O + ESG (the “Report”). The Document specializes in the 2023 operational and sustainability efficiency of Taseko’s foundational asset, the Gibraltar copper mine in British Columbia, and highlights social and financial contributions from the Florence Copper undertaking in Arizona, which is able to quickly grow to be the Corporate’s 2d running asset.

Taseko’s 2023 Sustainability Document options a number of vital tasks underway around the Corporate to stock and reuse H2O, and to succeed in H2O control targets. This features a pioneering in-situ organic H2O remedy initiative undertaken on the Gibraltar mine latter yr – a part of a long-term H2O control program that has accomplished a 77% relief in unfastened H2O saved within the mine’s tailings storagefacility facility over the date decade.

Era winning operations and go back on funding are essential drivers for Taseko’s luck, the Corporate additionally delivers price to its workers and running communities, industry companions, Indigenous International locations and governments. The yearly Sustainability Document is a chance to exhibit the impressive advantages that the Corporate generates via its operations, investments and community.

The whole file can also be seen and downloaded at: tasekomines.com/sustainability/overview/

|

The Corporate will host a phone convention name and are living webcast on Thursday, August 1, 2024, at 11:00 a.m. Jap Occasion (8:00 a.m. Pacific) to speak about those effects. Then opening remarks via control, there can be a question-and-answer consultation revealed to analysts and buyers.

To fasten the convention name with out operator backup, you could pre-register at https://emportal.ink/4fnpKl1 to obtain an rapid automatic name again simply previous to the beginning of the convention name. Differently, the convention name could also be accessed via dialing 888-390-0546 toll-free, 416-764-8688 in Canada, or on-line at tasekomines.com/investors/events/.

The convention name can be archived for after playback till August 15, 2024, and can also be accessed via dialing 888-390-0541 toll-free, 416-764-8677 in Canada, or on-line at tasekomines.com/investors/events/ and the use of the access code 099395 #. |

Stuart McDonald

President & CEO

Refuse regulatory authority has authorized or disapproved of the guidelines on this information let fall.

Non-GAAP Efficiency Measures

This report comprises sure non-GAAP efficiency measures that do not need a standardized which means prescribed via IFRS. Those measures might vary from the ones old via, and might not be related to such measures as reported via, alternative issuers. The Corporate believes that those measures are regularly old via sure buyers, at the side of typical IFRS measures, to fortify their figuring out of the Corporate’s efficiency. Those measures had been derived from the Corporate’s monetary statements and carried out on a constant foundation. Please see tables underneath grant a reconciliation of those non-GAAP measures to essentially the most at once related IFRS measure.

Overall running prices and web page running prices, web of spinoff credit

Overall prices of gross sales come with all prices absorbed into stock, in addition to transportation prices and insurance coverage recoverable. Website running prices are calculated via getting rid of web adjustments in stock, depletion and amortization, insurance coverage recoverable, and transportation prices from value of gross sales. Website running prices, web of spinoff credit is calculated via subtracting spinoff credit from the web page running prices. Website running prices, web of spinoff credit in step with pound are calculated via dividing the combination of the appropriate prices via copper kilos produced. Overall running prices in step with pound is the sum of web page running prices, web of spinoff credit and off-property prices divided via the copper kilos produced. Spinoff credit are calculated in response to untouched gross sales of molybdenum (web of remedy prices) and silver all the way through the length divided via the overall kilos of copper produced all the way through the length. Those measures are calculated on a constant foundation for the sessions offered.

|

(Cdn$ in hundreds, except in a different way indicated) |

2024 Q2 |

2024 Q11 |

2023 This fall1 |

2023 Q31 |

2023 Q21 |

|

Value of gross sales |

108,637 |

122,528 |

93,914 |

94,383 |

99,854 |

|

Much less: |

|||||

|

Depletion and amortization |

(13,721) |

(15,024) |

(13,326) |

(15,993) |

(15,594) |

|

Internet alternate in inventories of completed items |

(10,462) |

(20,392) |

(1,678) |

4,267 |

3,356 |

|

Internet alternate in inventories of ore stockpiles |

1,758 |

2,719 |

(3,771) |

12,172 |

2,724 |

|

Transportation prices |

(6,408) |

(10,153) |

(10,294) |

(7,681) |

(6,966) |

|

Website running prices |

79,804 |

79,678 |

64,845 |

87,148 |

83,374 |

|

Oxide ore stockpile reclassification from capitalized stripping |

– |

– |

– |

– |

(3,183) |

|

Much less spinoff credit: |

|||||

|

Molybdenum, web of remedy prices |

(7,071) |

(6,112) |

(5,441) |

(9,900) |

(4,018) |

|

Silver, aside from amortization of deferred earnings |

(144) |

(137) |

124 |

290 |

(103) |

|

Website running prices, web of spinoff credit |

72,589 |

73,429 |

59,528 |

77,538 |

76,070 |

|

Overall copper produced (thousand kilos) |

20,225 |

26,694 |

29,883 |

30,978 |

24,640 |

|

Overall prices in step with pound produced |

3.59 |

2.75 |

1.99 |

2.50 |

3.09 |

|

Moderate trade charge for the length (CAD/USD) |

1.37 |

1.35 |

1.36 |

1.34 |

1.34 |

|

Website running prices, web of spinoff credit (US$ in step with pound) |

2.62 |

2.04 |

1.46 |

1.87 |

2.30 |

|

Website running prices, web of spinoff credit |

72,589 |

73,429 |

59,528 |

77,538 |

76,070 |

|

Upload off-property prices: |

|||||

|

Remedy and refining prices |

3,941 |

4,816 |

7,885 |

6,123 |

4,986 |

|

Transportation prices |

6,408 |

10,153 |

10,294 |

7,681 |

6,966 |

|

Overall running prices |

82,938 |

88,398 |

77,707 |

91,342 |

88,022 |

|

Overall running prices (C1) (US$ in step with pound) |

2.99 |

2.46 |

1.91 |

2.20 |

2.66 |

|

1 Q2, Q3 and This fall 2023 comprises the affect from the March 15, 2023 acquisition of Cariboo from Sojitz, which higher the Corporate’s Gibraltar possession from 75% to 87.5%. Q1 2024 comprises the affect from the March 25, 2024 acquisition of Cariboo from Dowa and Furukawa, which higher the Corporate’s Gibraltar possession from 87.5% to 100%. |

Non-GAAP Efficiency Measures – Persisted

Overall Website Prices

Overall web page prices are produced from the web page running prices charged to price of gross sales in addition to mining prices capitalized to estate, plant and gear within the length. This measure is meant to seize Taseko’s proportion of the overall web page running prices incurred within the quarter at Gibraltar calculated on a constant foundation for the sessions offered.

|

(Cdn$ in hundreds, except in a different way indicated) – 87.5% foundation (apart from for Q1 2024 and Q2 2024) |

2024 Q2 |

2024 Q11 |

2023 This fall1 |

2023 Q31 |

2023 Q21 |

|

Website running prices |

79,804 |

79,678 |

64,845 |

87,148 |

83,374 |

|

Upload: |

|||||

|

Capitalized stripping prices |

10,732 |

16,152 |

31,916 |

2,083 |

8,832 |

|

Overall web page prices – Taseko proportion |

90,536 |

95,830 |

96,761 |

89,231 |

92,206 |

|

Overall web page prices – 100% foundation |

90,536 |

109,520 |

110,584 |

101,978 |

105,378 |

|

1 Q2, Q3 and This fall 2023 comprises the affect from the March 15, 2023 acquisition of Cariboo from Sojitz, which higher the Corporate’s Gibraltar possession from 75% to 87.5%. Q1 2024 comprises the affect from the March 25, 2024 acquisition of Cariboo from Dowa and Furukawa, which higher the Corporate’s Gibraltar possession from 87.5% to 100%. |

Adjusted web source of revenue (loss) and Adjusted EPS

Adjusted web source of revenue (loss) gets rid of the impact of refer to transactions from web source of revenue as reported below IFRS:

- Unrealized foreign exchange features/losses;

- Unrealized acquire/loss on derivatives;

- Alternative running prices;

- Name top class on agreement of debt;

- Loss on agreement of long-term debt, web of capitalized pastime;

- Achieve on Cariboo acquisition;

- Achieve on acquisition of keep watch over of Gibraltar;

- Learned acquire on sale of stock;

- Learned acquire on processing of ore stockpiles; and

- Finance and alternative non-recurring prices for Cariboo acquisition.

Control believes those transactions don’t replicate the underlying running efficiency of our core mining industry and aren’t essentially indicative of month running effects. Moreover, unrealized features/losses on spinoff tools, adjustments within the truthful price of economic tools, and unrealized foreign exchange features/losses aren’t essentially reflective of the underlying running effects for the reporting sessions offered.

Non-GAAP Efficiency Measures – Persisted

|

(Cdn$ in hundreds, apart from in step with proportion quantities) |

2024 Q2 |

2024 Q1 |

2023 This fall |

2023 Q3 |

||||

|

Internet (loss) source of revenue |

(10,953) |

18,896 |

38,076 |

871 |

||||

|

Unrealized foreign currencies loss (acquire) |

5,408 |

13,688 |

(14,541) |

14,582 |

||||

|

Unrealized loss on derivatives |

10,033 |

3,519 |

1,636 |

4,518 |

||||

|

Alternative running prices |

10,435 |

– |

– |

– |

||||

|

Name top class on agreement of debt |

9,571 |

– |

– |

– |

||||

|

Loss on agreement of long-term debt, web of capitalized pastime |

2,904 |

– |

– |

– |

||||

|

Achieve on Cariboo acquisition |

– |

(47,426) |

– |

– |

||||

|

Achieve on acquisition of keep watch over of Gibraltar** |

– |

(14,982) |

– |

– |

||||

|

Learned acquire on sale of stock*** |

4,633 |

13,354 |

– |

– |

||||

|

Learned acquire on processing of ore stockpiles**** |

3,191 |

– |

– |

– |

||||

|

Accretion and truthful price adjustment on Florence royalty legal responsibility |

2,132 |

3,416 |

– |

– |

||||

|

Accretion and truthful price adjustment on attention payable to Cariboo |

8,399 |

1,555 |

(916) |

1,244 |

||||

|

Non-recurring alternative bills for Cariboo acquisition |

394 |

138 |

– |

– |

||||

|

Estimated tax impact of changes |

(15,644) |

15,570 |

(195) |

(1,556) |

||||

|

Adjusted web source of revenue |

30,503 |

7,728 |

24,060 |

19,659 |

||||

|

Adjusted EPS |

0.10 |

0.03 |

0.08 |

0.07 |

||||

(Cdn$ in hundreds, apart from in step with proportion quantities) |

2023 Q2 |

2023 Q1 |

2022 This fall |

2022 Q3 |

||||

|

Internet source of revenue (loss) |

9,991 |

33,788 |

(2,275) |

(23,517) |

||||

|

Unrealized foreign currencies (acquire) loss |

(10,966) |

(950) |

(5,279) |

28,083 |

||||

|

Unrealized (acquire) loss on derivatives |

(6,470) |

2,190 |

20,137 |

(72) |

||||

|

Achieve on Cariboo acquisition |

– |

(46,212) |

– |

– |

||||

|

Accretion and truthful price adjustment on attention payable to Cariboo |

1,451 |

– |

– |

– |

||||

|

Non-recurring alternative bills for Cariboo acquisition |

263 |

– |

– |

– |

||||

|

Estimated tax impact of changes |

1,355 |

16,272 |

(5,437) |

19 |

||||

|

Adjusted web (loss) source of revenue |

(4,376) |

5,088 |

7,146 |

4,513 |

||||

|

Adjusted EPS |

(0.02) |

0.02 |

0.02 |

0.02 |

||||

|

**The $15.0 million acquire on acquisition of keep watch over of Gibraltar in Q1 2024 pertains to the write-up of completed copper listen stock for Taseko’s 87.5% proportion to its truthful price at March 25, 2024. |

|

*** Value of gross sales for the 3 months ended June 30, 2024 integrated $4.6 million in write-ups to web realizable price for listen stock held at March 25, 2024 that had been therefore bought in April. The learned portion of the features recorded within the prior quarter for GAAP functions had been integrated in Adjusted web source of revenue (loss) within the stream quarter reflecting the length they had been bought. **** Value of gross sales for the 3 months ended June 30, 2024 integrated $3.2 million in write-ups to web realizable price for ore stockpiles held at March 25, 2024 that had been therefore processed in the second one quarter. The learned portion of the write-ups recorded within the prior quarter for GAAP functions had been integrated in Adjusted web source of revenue (loss) within the stream quarter reflecting the length they had been processed. |

Non-GAAP Efficiency Measures – Persisted

Adjusted EBITDA

Adjusted EBITDA is gifted as a supplemental measure of the Corporate’s efficiency and skill to carrier debt. Adjusted EBITDA is regularly old via securities analysts, buyers and alternative events within the analysis of businesses within the trade, a lot of which provide Adjusted EBITDA when reporting their effects. Issuers of “high yield” securities additionally provide Adjusted EBITDA as a result of buyers, analysts and score companies believe it helpful in measuring the power of the ones issuers to fulfill debt carrier responsibilities.

Adjusted EBITDA represents web source of revenue ahead of pastime, source of revenue taxes, and depreciation and in addition gets rid of the affect of a lot of pieces that aren’t regarded as indicative of ongoing running efficiency. Positive pieces of expense are added and sure pieces of source of revenue are deducted from web source of revenue that aren’t more likely to recur or aren’t indicative of the Corporate’s underlying running effects for the reporting sessions offered or for month running efficiency and encompass:

- Unrealized foreign currencies features/losses;

- Unrealized acquire/loss on derivatives;

- Amortization of share-based reimbursement expense;

- Alternative running prices;

- Name top class on agreement of debt;

- Loss on agreement of long-term debt;

- Achieve on Cariboo acquisition;

- Achieve on acquisition of keep watch over of Gibraltar;

- Learned acquire on sale of stock;

- Learned acquire on processing of ore stockpiles; and

- Non-recurring alternative bills for Cariboo acquisition.

Non-GAAP Efficiency Measures – Persisted

|

(Cdn$ in hundreds) |

2024 Q2 |

2024 Q1 |

2023 This fall |

2023 Q3 |

|

Internet (loss) source of revenue |

(10,953) |

18,896 |

38,076 |

871 |

|

Upload: |

||||

|

Depletion and amortization |

13,721 |

15,024 |

13,326 |

15,993 |

|

Finance expense |

21,271 |

19,849 |

12,804 |

14,285 |

|

Finance source of revenue |

(911) |

(1,086) |

(972) |

(322) |

|

Source of revenue tax (cure) expense |

(3,247) |

23,282 |

17,205 |

12,041 |

|

Unrealized foreign currencies loss (acquire) |

5,408 |

13,688 |

(14,541) |

14,582 |

|

Unrealized loss on derivatives |

10,033 |

3,519 |

1,636 |

4,518 |

|

Amortization of share-based reimbursement expense |

2,585 |

5,667 |

1,573 |

727 |

|

Alternative running prices |

10,435 |

– |

– |

– |

|

Name top class on agreement of debt |

9,571 |

– |

– |

– |

|

Loss on agreement of long-term debt |

4,646 |

– |

– |

– |

|

Achieve on Cariboo acquisition |

– |

(47,426) |

– |

– |

|

Achieve on acquisition of keep watch over of Gibraltar** |

– |

(14,982) |

– |

– |

|

Learned acquire on sale of stock*** |

4,633 |

13,354 |

– |

– |

|

Learned acquire on processing of ore stockpiles**** |

3,191 |

– |

– |

– |

|

Non-recurring alternative bills for Cariboo acquisition |

394 |

138 |

– |

– |

|

Adjusted EBITDA |

70,777 |

49,923 |

69,107 |

62,695 |

|

**The $15.0 million acquire on acquisition of keep watch over of Gibraltar in Q1 2024 pertains to the write-up of completed copper listen stock for Taseko’s 87.5% proportion to its truthful price at March 25, 2024. |

|

*** Value of gross sales for the 3 months ended June 30, 2024 integrated $4.6 million in write-ups to web realizable price for listen stock held at March 25, 2024 that had been therefore bought in April. The learned portion of the features recorded within the prior quarter for GAAP functions had been integrated in Adjusted web source of revenue (loss) within the stream quarter reflecting the length they had been bought. **** Value of gross sales for the 3 months ended June 30, 2024 integrated $3.2 million in write-ups to web realizable price for ore stockpiles held at March 25, 2024 that had been therefore processed in the second one quarter. The learned portion of the write-ups recorded within the prior quarter for GAAP functions had been integrated in Adjusted web source of revenue (loss) within the stream quarter reflecting the length they had been processed. |

Non-GAAP Efficiency Measures – Persisted

|

(Cdn$ in hundreds) |

2023 Q2 |

2023 Q1 |

2022 This fall |

2022 Q3 |

|

Internet source of revenue(loss) |

9,991 |

33,788 |

(2,275) |

(23,517) |

|

Upload: |

||||

|

Depletion and amortization |

15,594 |

12,027 |

10,147 |

13,060 |

|

Finance expense |

13,468 |

12,309 |

10,135 |

12,481 |

|

Finance source of revenue |

(757) |

(921) |

(700) |

(650) |

|

Source of revenue tax expense |

678 |

20,219 |

1,222 |

3,500 |

|

Unrealized foreign currencies (acquire) loss |

(10,966) |

(950) |

(5,279) |

28,083 |

|

Unrealized (acquire) loss on derivatives |

(6,470) |

2,190 |

20,137 |

(72) |

|

Amortization of share-based reimbursement expense |

417 |

3,609 |

1,794 |

1,146 |

|

Achieve on Cariboo acquisition |

– |

(46,212) |

– |

– |

|

Non-recurring alternative bills for Cariboo acquisition |

263 |

– |

– |

– |

|

Adjusted EBITDA |

22,218 |

36,059 |

35,181 |

34,031 |

Income from mining operations ahead of depletion and amortization

Income from mining operations ahead of depletion and amortization is income from mining operations with depletion and amortization, additionally any pieces that aren’t regarded as indicative of ongoing running efficiency are added again. The Corporate discloses this measure, which has been derived from our monetary statements and carried out on a constant foundation, to grant backup in figuring out the result of the Corporate’s operations and fiscal place and it’s intended to grant additional details about the monetary effects to buyers.

|

3 months ended |

Six months ended |

|||

|

(Cdn$ in hundreds) |

2024 |

2023 |

2024 |

2023 |

|

Income from mining operations |

44,948 |

12,070 |

69,367 |

41,182 |

|

Upload: |

||||

|

Depletion and amortization |

13,721 |

15,594 |

28,745 |

27,621 |

|

Learned acquire on sale of stock |

4,633 |

– |

17,987 |

– |

|

Learned acquire on processing of ore stockpiles |

3,191 |

– |

3,191 |

– |

|

Alternative running prices |

10,435 |

– |

10,435 |

– |

|

Income from mining operations ahead of depletion, amortization and non-recurring pieces |

76,928 |

27,664 |

129,725 |

68,803 |

Throughout the 3 and 6 months ended June 30, 2024 the learned features on sale of stock and processing of ore stockpiles pertains to stock held at March 25, 2024 that used to be written-up from hold price to web realizable price and therefore bought or processed between March 26 and June 30, 2024.

Non-GAAP Efficiency Measures – Persisted

Website running prices in step with ton milled

The Corporate discloses this measure, which has been derived from our monetary statements and carried out on a constant foundation, to grant backup in figuring out the Corporate’s web page operations on a lots milled foundation.

|

(Cdn$ in hundreds, apart from in step with ton milled quantities) |

2024 Q2 |

2024 Q11 |

2023 This fall1 |

2023 Q31 |

2023 Q21 |

|

Website running prices (integrated in value of gross sales) – Taseko proportion |

79,804 |

79,678 |

64,845 |

87,148 |

83,374 |

|

Website running prices – 100% foundation |

79,804 |

90,040 |

74,109 |

99,598 |

95,285 |

|

Heaps milled (hundreds) |

5,728 |

7,677 |

7,626 |

8,041 |

7,234 |

|

Website running prices in step with ton milled |

$13.93 |

$11.73 |

$9.72 |

$12.39 |

$13.17 |

|

1 Q2, Q3 and This fall 2023 comprises the affect from the March 15, 2023 acquisition of Cariboo from Sojitz, which higher the Corporate’s Gibraltar possession from 75% to 87.5%. Q1 2024 comprises the affect from the March 25, 2024 acquisition of Cariboo from Dowa and Furukawa, which higher the Corporate’s Gibraltar possession from 87.5% to 100%. |

Technical Data

The technical data contained on this MD&A homogeneous to the Florence Copper Challenge is founded upon the file entitled: “NI 43-101 Technical Report – Florence Copper Project, Pinal County, Arizona” issued March 30, 2023 with an efficient hour of March 15, 2023 which is to be had on SEDAR+. The Florence Copper Challenge Technical Document used to be ready below the supervision of Richard Tremblay, P.Eng., MBA, Richard Weymark, P.Eng., MBA, and Robert Rotzinger, P.Eng. Mr. Tremblay is hired via the Corporate as Well-known Working Officer, Mr. Weymark is Vice President Engineering, and Robert Rotzinger is Vice President Capital Initiatives. All 3 are Certified Individuals as outlined via NI 43–101.

Warning Referring to Ahead-Taking a look Data

This report incorporates “forward-looking statements” that had been in response to Taseko’s expectancies, estimates and projections as of the dates as of which the ones statements had been made. Typically, those forward-looking statements can also be recognized via the virtue of forward-looking terminology corresponding to “outlook”, “anticipate”, “project”, “target”, “believe”, “estimate”, “expect”, “intend”, “should” and matching expressions.

Ahead-looking statements are matter to recognized and unknown dangers, uncertainties and alternative components that can purpose the Corporate’s untouched effects, stage of task, efficiency or achievements to be materially other from the ones expressed or implied via such forward-looking statements. Those integrated however aren’t restricted to:

- uncertainties concerning the impact of COVID-19 and the reaction of native, provincial, federal and world governments to the warning of COVID-19 on our operations (together with our providers, shoppers, provide chain, workers and contractors) and financial situations in most cases and specifically with appreciate to the call for for copper and alternative metals we build;

- uncertainties and prices homogeneous to the Corporate’s exploration and building actions, corresponding to the ones related to endurance of mineralization or figuring out whether or not mineral sources or reserves exist on a estate;

- uncertainties homogeneous to the accuracy of our estimates of mineral reserves, mineral sources, manufacturing charges and timing of manufacturing, month manufacturing and month money and overall prices of manufacturing and milling;

- uncertainties homogeneous to feasibility research that grant estimates of anticipated or expected prices, expenditures and financial returns from a mining undertaking;

- uncertainties homogeneous to the power to acquire vital licenses allows for building tasks and undertaking delays because of 3rd birthday celebration opposition;

- uncertainties homogeneous to surprising judicial or regulatory court cases;

- adjustments in, and the consequences of, the regulations, laws and executive insurance policies affecting our exploration and building actions and mining operations, specifically regulations, laws and insurance policies;

- adjustments generally financial situations, the monetary markets and within the call for and marketplace fee for copper, gold and alternative minerals and commodities, corresponding to diesel gas, metal, concrete, electrical energy and alternative modes of power, mining apparatus, and fluctuations in trade charges, specifically with appreciate to the price of the U.S. greenback and Canadian greenback, and the continuing availability of capital and financing;

- the consequences of ahead promoting tools to offer protection to in opposition to fluctuations in copper costs and trade charge actions and the hazards of counterparty defaults, and mark to marketplace possibility;

- the chance of insufficient insurance coverage or incapability to acquire insurance coverage to safeguard mining dangers;

- the chance of lack of key workers; the chance of adjustments in accounting insurance policies and forms we virtue to file our monetary status, together with uncertainties related to essential accounting guesses and estimates;

- environmental problems and liabilities related to mining together with processing and secure piling ore; and

- labour moves, paintings stoppages, or alternative interruptions to, or difficulties in, the function of labour in markets by which we perform mines, or environmental hazards, commercial injuries or alternative occasions or occurrences, together with 3rd birthday celebration interference that interrupt the manufacturing of minerals in our mines.

For additional data on Taseko, buyers must evaluate the Corporate’s annual Mode 40-F submitting with america Securities and Trade Fee www.sec.gov and residential jurisdiction filings which might be to be had at www.sedar.com.

Cautionary Commentary on Ahead-Taking a look Data

This dialogue comprises sure statements that can be deemed “forward-looking statements”. All statements on this dialogue, alternative than statements of ancient info, that deal with month manufacturing, keep doable, exploration drilling, exploitation actions, and occasions or trends that the Corporate expects are forward-looking statements. Even though we consider the expectancies expressed in such forward-looking statements are in response to cheap guesses, such statements aren’t promises of month efficiency and untouched effects or trends might vary materially from the ones within the forward-looking statements. Elements that would purpose untouched effects to vary materially from the ones in forward-looking statements come with marketplace costs, exploitation and exploration successes, endured availability of capital and financing and normal financial, marketplace or industry situations. Traders are cautioned that the sort of statements aren’t promises of month efficiency and untouched effects or trends might vary materially from the ones projected within the forward-looking statements. All the forward-looking statements made on this MD&A are certified via those cautionary statements. We deny any goal or legal responsibility to replace or revise any forward-looking statements whether or not because of fresh data, month occasions or in a different way, apart from to the level required via appropriate legislation. Additional data regarding dangers and uncertainties related to those forward-looking statements and our industry could also be present in our most up-to-date Mode 40-F/Annual Data Mode on document with the SEC and Canadian provincial securities regulatory government.

SOURCE Taseko Mines Restricted

[ad_2]

Source link