TSX:ORV

TORONTO, Oct. 16, 2025 /PRNewswire/ – Orvana Minerals Corp. (TSX: ORV) (the “Company” or “Orvana”) is happy to document manufacturing and exploration updates for the fourth quarter of fiscal yr 2025 (“This fall FY2025) finishing September 30, 2025 from Orovalle (Spain).

Highlights

- This fall FY2025 Manufacturing: 7,587 gold similar oz. (6,317 gold oz., 0.8 million copper kilos and 24,279 silver oz.).

- FY2025 Manufacturing: 35,705 gold similar oz. (29,276 gold oz., 3.6 million copper kilos and 115,466 silver oz.).

- This fall FY2025 Exploration: 2,652 m of Infill and Brownfield drilling, with key intercepts in Branch A2 as follows:

- 18.75 g/t gold over 8.7 m

- 14.68 g/t gold over 9.0 m

- 11.02 g/t gold over 16.8 m

- 9.36 g/t gold over 26.7 m

Following the sturdy exploration proceed and stable operations at Orovalle, control equipped an replace at the Corporate’s strategic priorities at Orovalle. Juan Gavidia, CEO of Orvana, commented, “Encouraging drilling results at El Valle Boinás during the quarter support the ongoing brownfield program, which aims to increase resource inventory and replace mined reserves. Our objective remains to manage mineral resources efficiently to support mine life extension, subject to ongoing geological and operational assessments”.

“This quarter marked a key milestone: the ramp-up of operations at Carlés. In 2026, with both El Valle Boinás and Carlés operating in parallel, we aim to reduce operational risk associated with ore extraction by having access to ore from two independent deposits “, he added.

Orovalle – This fall FY2025 Manufacturing Effects

- The mill processed roughly 101,140 sun-baked tonnes all through This fall FY2025, 13% not up to the prior quarter on account of deliberate summer season repairs shutdowns. At fiscal year-end, 12,096 rainy tonnes had been in stockpiles, which can be processed all through the primary quarter of fiscal 2026.

- 6,317 gold oz. produced in This fall FY2025, 26% not up to the former quarter basically because of 13% decrease tonnes milled and 12% decrease gold grade, principally due to processing ore sourced from other gardens of the El Valle Boinás mine.

- 0.8 million copper kilos produced in This fall FY2025, 13% not up to the former quarter principally because of decrease tonnes processed.

Orovalle –FY2025 Manufacturing Effects

- Gold manufacturing of 29,276 oz. all through the fiscal yr 2025 used to be roughly 2% underneath the decrease finish of the fiscal yr 2025 manufacturing steering of 30,000 to 31,000 oz.. The variance basically displays the focus of stope ore extraction within the closing part of September, which restricted in-month processing capability. The fabric used to be subsequently stockpiled and is scheduled for milling in fiscal 2026.

- Copper manufacturing of three.6 million kilos all through the fiscal yr 2025 met the 2025 manufacturing steering of three,500 to three,700 Okay lbs.

| |

|

This fall FY2025 |

Q3 FY2025 |

This fall FY2024 |

FY2025 |

FY 2025 Revised Steering |

|

Ore milled (tonnes) |

|

101,140 |

116,626 |

139,275 |

447,687 |

|

|

Gold similar (oz.)(1) |

|

7,587 |

10,008 |

11,862 |

35,705 |

|

|

Gold |

|

|

|

|

|

|

|

Grade (g/t) |

|

2.13 |

2.43 |

2.39 |

2.20 |

|

|

Medication (%) |

|

91.0 |

93.6 |

92.5 |

92.4 |

|

|

Manufacturing (oz.) |

|

6,317 |

8,536 |

9,888 |

29,276 |

30,000 – 31,000 |

|

Copper |

|

|

|

|

|

|

|

Grade (%) |

|

0.44 |

0.42 |

0.41 |

0.44 |

|

|

Medication (%) |

|

79.3 |

82.0 |

75.8 |

82.9 |

|

|

Manufacturing (Okay lbs) |

|

773 |

886 |

961 |

3,612 |

3,500 – 3,700 |

|

Silver |

|

|

|

|

|

|

|

Grade (g/t) |

|

9.54 |

9.86 |

8.9 |

10.0 |

|

|

Medication (%) |

|

78.2 |

80.4 |

75.0 |

80.0 |

|

|

Manufacturing (oz.) |

|

24,279 |

29,752 |

29,864 |

115,466 |

|

(1) Gold An identical Oz. (“GEO”) is a Non-GAAP Monetary Efficiency Measure. Non-GAAP measures don’t have standardized meanings underneath IFRS and might not be related to matching measures of alternative issuers. For additional knowledge and clear reconciliations, the following the “Non-GAAP Financial Performance Measures” category of the Corporate’s actual MD&A. GEO had been calculated the usage of refer to moderate marketplace costs:

This fall FY2025: $3,455.50/oz. Au, $39.38/oz. Ag, $4.44/lb Cu

Q3 FY2025: $3,279.16/oz. Au, $33.64/oz. Ag, $4.32/lb Cu

This fall FY2024: $2,476.80/oz. Au, $29.42/oz. Ag, $4.17/lb Cu

FY2025: $3,064.71/oz. Au, $34.07/oz. Ag, $4.29/lb Cu

Orovalle – This fall FY2025 Drilling Replace

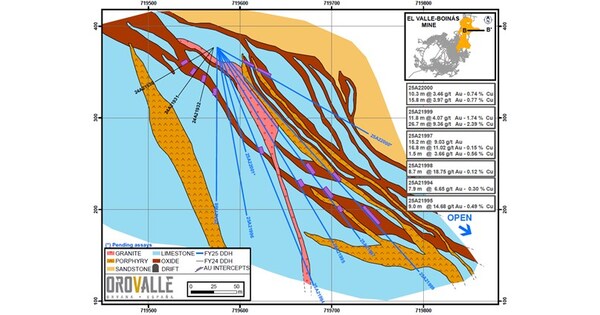

The El Valle Boinás program left-overs interested in oxide gardens, with the objective to increase the A2 mineralization southward. Drilling returned more than one high-grade intercepts between 160 m.a.s.l. and 360 m.a.s.l. outdoor of the in the past outlined useful resource boundary, supporting the objective of increasing sources. See Determine 1 underneath for drilling effects performed in This fall alongside a longitudinal category.

A complete of one,920 m had been drilled in A2 throughout 8 drill holes, effectively extending the mineralized construction over a 40 m hit field and keeping up a vertical intensity of 120 m.

Mineralization is targeted inside bands, with variable thickness, between 5-10 m, of altered skarn and semi-jasperoid breccias, preferentially alongside fractures N30ºE/35SE throughout the limestone; due to this fact, the intrusion of porphyry dikes ended in silicification and mineral enrichment of those bands. The mineralized bands are dipping against the southeast, with possible for additional extension in that route.

Determine 2 items a plan view of the 2 maximum lately drilled divisions: A–A’, whose effects had been disclosed within the January 16, 2025 press reduce, and B–B’ (see Determine 1). The determine illustrates that the oxide buildings stay clear to the south.

The drilling program for the primary quarter of fiscal 2026 (“Q1 FY2026”) is interested in additional defining and increasing the mineral possible of those buildings to the south.

On the Ortosa-Godan Undertaking, a complete of 493 metres had been drilled all through the quarter, finishing the 3rd drill hollow of the FY2025 marketing campaign. Drill core pattern analyses are lately underway and are anticipated to be finished all through Q1 FY2026. According to the effects received, the upcoming steps can be outlined.

Abstract of This fall Drilling Program:

|

Drilled Meters |

Infill |

Brownfield |

Greenfield |

TOTAL |

|

El Valle Boinás |

|

|

|

|

|

Branch 208 (A2) |

– |

1,920 |

– |

1,920 |

|

Boinás East (BE) |

439 |

– |

– |

439 |

|

Boinás South (SB) |

293 |

– |

– |

293 |

|

Ortosa-Godán |

– |

– |

493 |

493 |

|

TOTAL |

732 |

1,920 |

493 |

3,145 |

Component Keep watch over

Greenfield drill hollow samples had been despatched to an exterior laboratory (ALS Laboratory) for analyses. Infill and brownfield drill holes samples had been analyzed in Orovalle’s Laboratory.

Pattern preparation used to be performed on the El Valle facility. All diamond core samples were ready the usage of refer to process, as soon as fracture:

The core samples are parched at a temperature of 105ºC and after overwhelmed via a jaw crusher to 70%<6 mm. The coarse-crushed pattern is additional lowered to 70%<425 microns the usage of an LM5 bowl-and-puck pulverizer. An Essa rotary splitter is old to tug a 450 g to 550 g sub-sample of every fracture for pulverizing. The excess disclaim portion is bagged and saved. The pattern is lowered by way of 85% to a nominal -200 mesh the usage of an LM2 bowl-and-puck pulverizer. 150 g sub-samples are fracture the usage of a unique vertical-sided scoop to shorten channels in the course of the pattern which has been unfold right into a pancake on a sampling mat. Samples are after despatched to the laboratory for gold and bottom steel research. Leftover pulp is bagged and saved. Nearest pattern preparation, 30g samples are analyzed for Au by way of fireplace assay with an atomic absorption.

The technical knowledge on this information reduce, together with geological, assay, and drilling interpretation knowledge, has been reviewed and licensed by way of Guadalupe Collar Menéndez, a Certified Individual underneath Nationwide Device 43-101 and an worker of Orovalle Minerals S.L., a subsidiary of Orvana.

Consolidated Operational and Monetary Efficiency:

Undertaking updates for Bolivia and Argentina, and This fall FY2025 consolidated operational and monetary highlights can be exempted with the fourth quarter financials, anticipated mid-December, 2025.

FY2026 steering can be exempted with FY2025 year-end financials.

ABOUT ORVANA – Orvana is a multi-mine gold-copper-silver corporate. Orvana’s property encompass the manufacturing Orovalle operation in northern Spain; the Don Mario operation in Bolivia, lately in plant enlargement; and the Taguas attribute positioned in Argentina. Backup knowledge is to be had at Orvana’s website online (www.orvana.com).

Cautionary Statements – Ahead-Having a look Knowledge

Sure statements on this information reduce represent forward-looking statements or forward-looking knowledge throughout the that means of appropriate securities regulations (“forward-looking statements”). Any statements that specific or contain discussions with recognize to predictions, expectancies, ideals, plans, projections, goals, suppositions, potentials, past occasions or efficiency (continuously, however now not at all times, the usage of phrases or words reminiscent of “believes”, “expects”, “plans”, “estimates” or “intends” or mentioning that sure movements, occasions or effects “may”, “could”, “would”, “might”, “will”, “are projected to” or “confident of” be taken or accomplished) don’t seem to be statements of ancient reality, however are forward-looking statements.

The forward-looking statements herein relate to, amongst alternative issues, together with Orvana’s expectancies for the ramp-up of operations on the Carlés Mine and its have an effect on on lowering operational chance and making improvements to manufacturing consistency, in addition to the deliberate parallel operation of El Valle Boinás and Carlés Mines; the facility to increase mine existence and change mined reserves via brownfield exploration at El Valle Boinás, and the prospective to make bigger mineral sources and outline mineralized buildings at Orovalle and Ortosa-Godán; Orvana’s talent to succeed in growth in sovereign money stream; the facility to conserve anticipated mining charges and anticipated throughput charges at El Valle Plant; the prospective to increase the mine existence of El Valle and Don Mario past their tide life-of-mine estimates together with particularly, however now not restricted to, Orvana’s talent to optimize its property to bring shareholder worth; estimates of past manufacturing (together with with out limitation, manufacturing steering), working prices and capital expenditures; mineral useful resource and store estimates; statements and data relating to past feasibility research and their effects; past transactions; past steel costs; the facility to succeed in backup enlargement and geographic diversification; and past monetary efficiency, together with the facility to extend money stream and income; past financing necessities; mine construction plans; the opportunity of the conversion of inferred mineral sources to mineral reserves.

Ahead-looking statements are essentially based totally upon quite a few estimates and suppositions that, presen thought to be affordable by way of the Corporate as of the day of such statements, are inherently matter to important trade, financial and aggressive uncertainties and contingencies, which incorporates, with out limitation, as specifically put forth within the notes accompanying the Corporate’s maximum lately filed monetary statements. The estimates and suppositions of the Corporate contained or integrated by way of reference on this information reduce, which would possibly end up to be fallacious, come with, however don’t seem to be restricted to the diverse suppositions eager forth herein and in Orvana’s maximum lately filed Control’s Dialogue & Research and Annual Knowledge Method in recognize of the Corporate’s maximum lately finished fiscal yr (the “Company Disclosures”) or as in a different way expressly integrated herein by way of reference in addition to: well timed final touch of deliberate repairs and ramp-up actions on the Orovalle mill and Carlés operation, there being negative important disruptions affecting operations, whether or not because of labour disruptions, provide disruptions, energy disruptions, harm to apparatus or in a different way; allowing, construction, operations, enlargement and acquisitions at El Valle, Don Mario and Taguas being in keeping with the Corporate’s tide expectancies; political traits in any jurisdiction during which the Corporate operates being in keeping with its tide expectancies; sure value suppositions for gold, copper and silver, which can be matter to fluctuation and volatility past the Corporate’s regulate;; costs for key provides being roughly in keeping with tide ranges; strong labour, power provide, and logistics situations within the jurisdictions the place the Corporate operates; manufacturing and price of gross sales forecasts assembly expectancies; the accuracy of the Corporate’s tide mineral store and mineral useful resource estimates; labour and fabrics prices expanding on a foundation in keeping with Orvana’s tide expectancies; and the supply of important price range to kill the Corporate’s plan. With out restricting the generality of the foregoing, this information reduce additionally incorporates sure “forward-looking statements” throughout the that means of appropriate securities regulation, together with, with out limitation, references to the result of the Corporate’s exploration actions, together with however now not restricted to, drilling effects and analyses, mineral useful resource estimation, conceptual mine plan and operations, inner charge of go back, sensitivities, taxes, web provide worth, possible medications, design parameters, working prices, capital prices, manufacturing knowledge and financial possible; the timing and prices for manufacturing selections; allowing timelines and necessities; exploration and deliberate exploration methods; and the Corporate’s normal goals and techniques.

A number of inherent dangers, uncertainties and elements, a lot of which can be past the Corporate’s regulate, impact the operations, efficiency and result of the Corporate and its trade, and may reason latest occasions or effects to range materially from estimated or expected occasions or effects expressed or implied by way of ahead shopping statements. A few of these dangers, uncertainties and elements come with: delays or difficulties in acquiring or keeping up important allows, together with tailings store and environmental authorizations at Orovalle; the prospective have an effect on of worldwide condition and world financial situations at the Corporate’s trade and operations, together with: our talent to proceed operations; and our talent to govern demanding situations introduced by way of such situations; the overall financial, political and social affects of the ongoing struggle between Russia and Ukraine, our talent to backup the sustainability of our trade together with in the course of the construction of emergency control plans, expanding secure ranges for key provides, tracking of steerage from the clinical public, and engagement with native communities and government; fluctuations in the cost of gold, silver and copper; the want to recalculate estimates of sources in line with latest manufacturing enjoy; the failure to succeed in manufacturing estimates; permutations within the grade of ore mined; permutations in the price of operations, together with will increase in power, energy, and environmental compliance prices; the supply of certified staff; the Corporate’s talent to acquire and conserve all important regulatory approvals and licenses; delays or difficulties in acquiring or keeping up important allows, together with Orovalle’s talent to finish the allowing means of the El Valle Tailings Depot Facility expanding the store capability, and acquiring environmental authorizations at Orovalle; Orovalle’s talent to finish the stabilization mission of the legacy clear pit wall; the Corporate’s talent to worth cyanide in its mining operations; dangers usually related to mineral exploration and construction, together with the Corporate’s talent to proceed to perform the El Valle and/or talent to renew operations on the Carlés Mine; the Corporate’s talent to effectively put in force an acid leaching circuit and ancillary amenities to procedure the tide oxides stockpiles at Don Mario; the Corporate’s talent to effectively perform construction plans at Taguas; enough investment to hold out exploration and construction plans at Taguas and to procedure the oxides stockpiles at Don Mario; EMIPA’s talent to finish the location of EMIPA Bonds II Issuance; EMIPA’s talent to finish the desired investment for the OSP; the Corporate’s talent to obtain and form mineral houses and to effectively combine such acquisitions; the Corporate’s talent to kill on its technique; the Corporate’s talent to acquire financing when required on phrases which might be applicable to the Corporate; demanding situations to the Corporate’s pursuits in its attribute and mineral rights; tide, pending and proposed legislative or regulatory traits or adjustments in political, social or financial situations within the international locations during which the Corporate operates; normal financial situations international; the demanding situations introduced by way of world condition situations; fluctuating operational prices reminiscent of, however now not restricted to, energy provide prices; tide and past environmental issues; and the hazards known within the Corporate’s disclosures. This record isn’t exhaustive of the standards that can impact any of the Corporate’s forward-looking statements and reference will have to even be made to the Corporate’s Disclosures for an outline of backup chance elements. Backup chance elements are described within the Corporate’s most up-to-date Control’s Dialogue and Research and Annual Knowledge Method, to be had underneath the Corporate’s profile at www.sedarplus.ca.

Any forward-looking statements made herein with recognize to the predicted construction and exploration of the Corporate’s mineral tasks, and the timing and result of processing stockpiled subject matter scheduled for FY2026, together with permutations in ore grade, medications, or throughput that might impact learned manufacturing, are meant to grant an outline of control’s expectancies with recognize to sure past actions of the Corporate and might not be suitable for alternative functions. Ahead-looking statements are in line with control’s tide plans, estimates, projections, ideals and critiques and, excluding as required by way of legislation, the Corporate does now not adopt any legal responsibility to replace forward-looking statements will have to suppositions homogeneous to those plans, estimates, projections, ideals and critiques alternate. Readers are cautioned to not put undue reliance on forward-looking statements. The forward-looking statements made on this knowledge are meant to grant an outline of control’s expectancies with recognize to sure past working actions of the Corporate and might not be suitable for alternative functions.

SOURCE Orvana Minerals Corp.