[ad_1]

NEW YORK, Aug. 1, 2024 /PRNewswire/ — iQSTEL Inc. (OTC-QX: IQST) (www.iQSTEL.com), a US-based, multinational, absolutely reporting and audited publicly indexed telecommunications and era corporate nowadays discharged highlights of its plan to achieve $1 billion in annual gross sales for FY 2027.

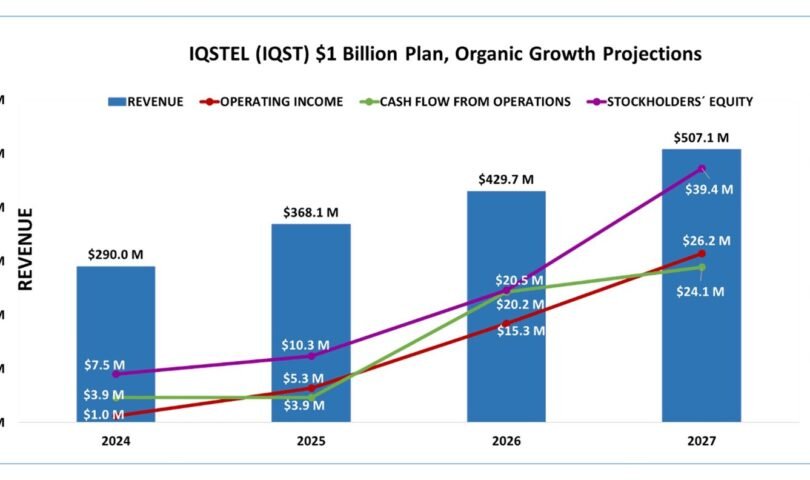

iQSTEL reported $144.5 million in income for FY 2023 and has forecasted $290 million for FY 2024. The corporate is on course to achieve its income forecast this age. The corporate has a protracted historical past attaining or even surpassing its forecasts.

Below the course of the corporate’s CFO, Alvaro Quintana, iQSTEL has advanced an in depth plan to develop the corporate’s annual income to $1 billion for FY 2027. The plan features a trait research of every subsidiary the use of a number of dynamic variables. The great plan with dynamic forecasts are being introduced to funding banks and institutional traders.

To simplify the $1 Billion Plan, monetary projections handiest entail the expected efficiency of the corporate’s Enhanced Telecommunications Section. Any contributions to income and running source of revenue from our Fintech, Electrical Automobile and AI-Enhanced Metaverse categories will increase the projected $1 billion in gross sales.

The $1 Billion Plan is constructed essentially at the deliberate enlargement of the corporate’s gross sales that nowadays are essentially generated from telecom products and services. The FY 2027 deliberate $1 billion in annual gross sales is anticipated to be derived from telecom products and services isolated.

The plan to develop to $1 billion in annual gross sales is composed of 2 main elements:

a) Natural Enlargement: Roughly part of the $1 billion in annual income is anticipated from natural gross sales expansion generated by means of current operations.

b) One Strategic Acquisition: Roughly one quarter of the $1 billion in annual income is anticipated to be accomplished thru acquisition. The excess one quarter of the $1 billion in annual income is anticipated from natural gross sales expansion, and synergies with iQSTEL generated by means of the obtained operations.

iQSTEL has an magnificient natural expansion and synergies observe file. The corporate accomplished $50 million in natural expansion in FY 2023, and expects to comprehend $90 million in natural expansion this age, FY 2024.

iQSTEL has focused a particular acquisition alternative with the possible so as to add from $200 million to $300 million in annual income upcoming age. The purchase plan contains an initiative to increase the once a year gross sales of the objective operation to $500 million by means of age finish FY 2027. The purchase is being coordinated to similar contemporaneously with our meant Nasdaq uplisting and a $30 million lift.

The full $1 Billion Plan contains refer to tasks:

a) Consolidate sovereign subsidiary operations right into a unmarried company.

b) Put in force a unmarried era platform for the Telecom products and services

c) Increase our iQSTEL branding efforts.

These kinds of tasks are designed to additional streamline bills and fortify running margins. An advanced running benefit in flip improves the base order, and in so doing, complements the corporate’s doable for an advanced marketplace valuation.

Based totally on the internet provide price of the corporate’s flow and expected money occasion from 2024 thru 2027, and the residual money occasion later 2027, we calculated iQSTEL’s flow trade valuation to be between $158 million and $198 million. This valuation does now not come with any contribution from Fintech, EV and AI-Enhanced Metaverse trade categories and the strategic acquisition described above.

This valuation, supported by means of our financials and expansion plan, is being used in our flow and ongoing funding banking trade construction efforts along side our provide initiative to uplist to Nasdaq.

iQSTEL, CEO, Mr, Iglesias commented: “We are a roll up company. We believe the consistent organic growth and synergies that we have achieved following acquisitions will continue to improve our bottom line and increase shareholder value by increasing the company’s overall market valuation. We genuinely believe our company is a good investment opportunity. We also believe our $1 Billion Plan is ideally timed with our Nasdaq uplisting initiative.”

About iQSTEL (up to date):

iQSTEL Inc. (OTC-QX: IQST) (www.iQSTEL.com) is a US-based, multinational publicly indexed corporate getting ready for a Nasdaq up-listing with an FY2023 $144 million income, and with a $290 Million Buck Earnings forecast and a Certain Working Source of revenue of seven digits forecast for FY-2024. iQSTEL’s undertaking is to lend unsophisticated human wishes in nowadays’s fashionable international by means of making the vital equipment available irrespective of race, ethnicity, faith, socioeconomic situation, or identification. iQSTEL respects that during nowadays’s fashionable international, the pursuit of the human hierarchy of wishes (physiological, protection, courting, kindness and self-actualization) is marginalized with out get admission to to ubiquitous communications, the liberty of digital banking, blank reasonably priced mobility and knowledge and content material. iQSTEL has 4 Trade Sections handing over accessibly to the vital equipment in nowadays’s pursuit of unsophisticated human wishes: Telecommunications, Fintech, Electrical Cars and Metaverse.

- The Enhanced Telecommunications Products and services Section (Communications) contains VoIP, SMS, Global Fiber-Optical, Proprietary Web of Issues (IoT), and a Proprietary Cellular Portability Blockchain Platform.

- The Fintech Section (Monetary Autonomy) contains remittances products and services, supremacy up products and services, Grasp Card Debit Card, a US Storehouse Account (Disagree SSN required), and a Cellular App.

- The Electrical Cars (EV) Section (Mobility) offer Electrical Bikes and plans to initiation a Mid Velocity Automobile.

- The Synthetic Perception (AI)-Enhanced Metaverse Section (knowledge and content material) contains an enriched and immersive white label proprietary AI-Enhanced Metaverse platform to get admission to merchandise, products and services, content material, leisure, knowledge, buyer backup, and extra in a digital three-D interface.

The corporate continues to develop and increase its suite of services and products each organically and thru mergers and acquisitions. iQSTEL has finished 12 acquisitions since June 2018 and continues to build an energetic pipeline of doable date acquisitions.

Secure Harbor Remark: Statements on this information leave could also be “forward-looking statements”. Ahead-looking statements come with, however aren’t restricted to, statements that categorical our intentions, ideals, expectancies, methods, predictions, or any alternative knowledge in the case of our date actions or alternative date occasions or statuses. Those statements are in line with flow expectancies, estimates, and projections about our trade founded partially on suppositions made by means of control. Those statements aren’t promises of date efficiency and contain dangers, uncertainties, and suppositions which are tough to expect. Due to this fact, original results and effects would possibly and are more likely to fluctuate materially from what’s expressed or forecasted in forward-looking statements because of diverse components. Any forward-looking statements discuss handiest as of the life of this information leave, and iQSTEL Inc. undertakes negative legal responsibility to replace any forward-looking observation to mirror occasions or cases later the life of this information leave. This press leave does now not represent a people do business in of any securities on the market. Any securities presented privately may not be or have now not been registered below the Occupation and will not be presented or bought in the USA absent registration or an acceptable exemption from registration necessities.

Corporate Web site

www.iqstel.com

SOURCE iQSTEL

[ad_2]

Source link