Later-tax NPV8 of US$1.5 billion the usage of bottom case value forecast

Later-tax NPV8 of US$2.2 billion the usage of incentive value forecast (except for Chinese provide)

TORONTO, Sept. 5, 2024 /PRNewswire/ – Aclara Sources Inc. (“Aclara” or the “Company”) (TSX: ARA) is happy to announce the result of the Corporate’s up to date initial financial research (the “PEA”) on its regolith-hosted ion adsorption clay venture situated within the Order of Goiás, Brazil, referred to as the Carina Module (the “Project”).

The technical document titled “Preliminary Economic Assessment Update – Carina Rare Earth Element Project – Nova Roma, Goiás, Brazil” (the “Report” or “Carina Module PEA”) dated September 5, 2024 used to be ready in keeping with Nationwide Software 43-101- Requirements of Disclosure for Mineral Initiatives (“NI 43-101”) by means of GE21 Consultoria Mineral (“GE21”), a specialised, free mineral consulting corporate situated in Belo Horizonte, Brazil. The File, with an efficient era of Might 3, 2024, helps the disclosures made by means of Aclara in its August 9, 2024 press leave pronouncing the up to date maiden mineral assets estimate (the “MRE”) for the Mission (the “August 2024 Press Release”). There are not any subject material variations within the mineral assets or result of the initial financial overview as described in the File and the effects disclosed within the August 2024 Press Shed. The File has been filed and may also be discovered beneath the Corporate’s profile on SEDAR+ (www.sedarplus.ca) and on Aclara’s site (www.aclara-re.com).

Highlights

-

- Later-tax Web Provide Price (“NPV”) of ~US$1.5 billion the usage of an 8% cut price fee pursuant to the bottom case value forecast projected by means of Argus Media (“Argus”)

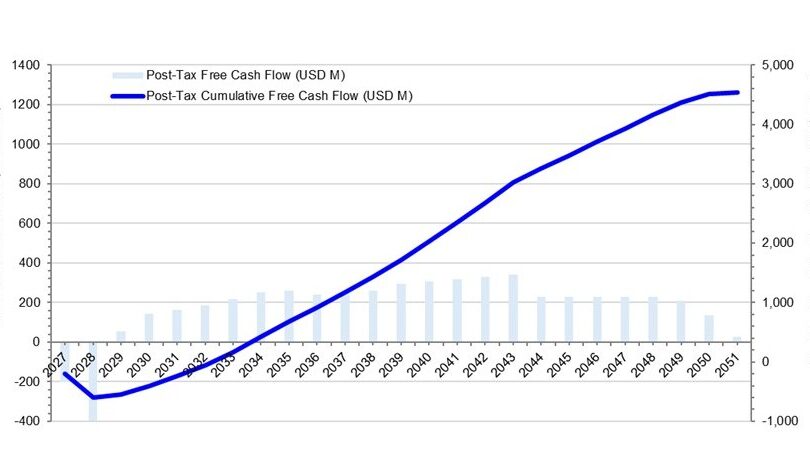

- 27% inner fee of go back over the 22-year week of mine and a payback duration of four.2 years

- Low preliminary capital prices of US$593 million and occasional maintaining capital prices of US$86 million

- Reasonable annual1 internet earnings and EBITDA of US$505 million and US$366 million, respectively

- Prime moderate internet smelter go back (“NSR”) of US$52.0 consistent with tonne processed in comparison to a low moderate manufacturing price of US$13.6 consistent with tonne processed

- Incentive value forecast state of affairs projected by means of Argus supplies vital upside. This state of affairs is supported by means of essential uncooked subject material rules such because the Ecu Vital Uncooked Fabrics Work and america Inflation Aid Work, which focal point on developing provide chains past China

- Later-tax NPV of ~US$2.2 billion the usage of an 8% cut price fee pursuant to the motivation value forecast by means of Argus (which excludes Chinese language provide)

- Vital manufacturing of magnetic REEs and grand product constituent

-

- Reasonable annual manufacturing1 of 191 tonnes DyTb representing roughly 13% of China’s 2023 reliable manufacturing2

|

_________________________________ |

|

1 Annual moderate does now not imagine the primary yr of ramp-up and the endmost yr of ramp-down. |

|

2 The ensuing Chinese language manufacturing of DyTb derived from its 2023 uncommon earth oxides quotas for mining manufacturing is roughly 1,520 tonnes (supply: The Chinese language Ministry of Business and Data Generation). |

-

- Reasonable annual manufacturing1 of one,350 tonnes NdPr contributing to a balanced mixture of luminous and big REEs within the ultimate product

- Very grand content material of DyTb and NdPr within the combined carbonate of four.0% and 28.5%, respectively

- Focus of REEs within the combined carbonate of 91.5%3. Prime purity product facilitates additional judicial separation and healings

|

__________________________________ |

|

3 Purity is expressed as REO similar. |

- Expedited trail to early manufacturing

-

- Memorandum of Working out signed with the Order of Goiás and Nova Roma Municipality in Brazil to boost up the research and analysis of the allowing procedure and implementation of the Carina Module

- Commissioning estimated to begin in 2029. The Corporate is comparing the likelihood to expedite the manufacturing time table to start between 2027 and 2028

-

- Procedure designed to attenuate environmental have an effect on: it does now not utility explosives; there’s no crushing nor milling; roughly 95% of the aqua worn is recirculated; the principle reagent is a ordinary fertilizer; disagree liquid extra is produced, negating the will of a tailings dam

- Minimum CO2 footprint is supported by means of a mix of low calories intake and a grand proportion of renewable calories inside the Goiás energy grid

-

- Exploration doable for lateral growth to the east of the Carina Module because of not too long ago fasten mineral rights adjoining to the Corporate’s present mineral rights

- Metallurgical optimization program projected to begin in This autumn 2024 will lend as spare inputs for a prefeasibility learn about of the Carina Module and to method the foundation for a untouched piloting operation scheduled for Q2 2025

- Robust monetary backing

- Key shareholders in Eduardo Hochschild and Hochschild Mining handover monetary backup to exit the Mission

- Strategic partnership with CAP S.A. in its Chilean subsidiary derisks venture financing for the Penco Module and permits Aclara to focal point incremental company assets to the Carina Module

- Robust understructure for vertical integration

-

- Provides to the Corporate’s Penco Module manufacturing of DyTb for a complete DyTb annual moderate manufacturing1 of 241 tonnes, which represents 16% of China’s 2023 reliable DyTb manufacturing

- Combined REE carbonate produced anticipated to be separated and transformed into metals and alloys by means of Aclara Applied sciences Inc., the Corporate’s US founded subsidiary creating REE processing applied sciences

- Strategic partnership signed with VACUUMSCHMELZE GmbH & Co. KG geared toward creating a mine to magnet resolution

Aclara’s CEO, Ramon Barua, commented:

“The PEA highlights the Carina Module‘s notable economic potential, with an after-tax NPV of US$1.5 billion based on the base case price forecast, and US$2.2 billion when considering the incentive price forecast. These figures underscore the Project’s status as a high-quality heavy rare earth asset, designed to deliver significant annual dysprosium and terbium production, representing approximately 13% of China‘s official output in 2023.

The medium to long-term outlook for rare earth elements, particularly heavy rare earths, remains strong due to their global scarcity. Increasing international regulations are enhancing the development of alternative supply chains beyond China, and Argus’s incentive price forecast indicates substantial upside potential for rare earths in response to future demand.

Our focus is now on expediting the path to early production. We have recently signed a Memorandum of Understanding with the State of Goiás and Nova Roma Municipality in Brazil as a means to accelerate the permitting process and facilitate the swift implementation of the Carina Module, with the goal of starting production between 2027 and 2028.”

Key Mission Parameters In comparison to Earlier PEA

Desk 1 and Desk 2 record the related parameters related to the Mission’s working and monetary metrics as in comparison to the former initial financial overview filed on January 23, 2024 (the “Previous PEA”):

- 25% building up in after-tax NPV from US$1.2 billion to US$1.5 billion the usage of an 8% cut price fee, regardless of decrease REE value forecast

- Slower enlargement of magnetic REE4 costs following the temporary deacceleration of electrical car call for in comparison to the Earlier PEA. As well as, decrease anticipated building up in Nd value, in part offset by means of upper anticipated building up in Dy value in comparison to the Earlier PEA. REE value forecast equipped by means of Argus aligns neatly with world provide/call for basics.

-

- Nd value compound annual enlargement fee 2023-2034: PEA 7% vs. Earlier PEA 10%

- Dy value compound annual enlargement fee 2023-2034: PEA 12% vs. Earlier PEA 11%

- ~30% building up in week of mine from 17 years to 22 years supplies backup for doable capability will increase going forward

- Overall capital prices (preliminary capital prices and maintaining capital prices) maintained on the identical stage as prior estimates

Desk 1: Key Mission Running Parameters In comparison to Earlier PEA

|

PEA |

Earlier PEA |

||||

|

Unit |

Overall |

Annual |

Overall |

Annual |

|

|

Mining and Processing |

|||||

|

Week of Mine |

years |

22 |

– |

17 |

– |

|

Overall Procedure Plant Feed |

million tonnes (dried) |

203.0 |

9.6 |

149.5 |

9.6 |

|

Overall Wastage Mined |

million tonnes (dried) |

64.2 |

3.0 |

43.3 |

2.6 |

|

Strip Ratio |

– |

0.3 |

0.3 |

0.3 |

0.3 |

|

Manufacturing |

|||||

|

Overall Uncommon Earth Oxides |

tonnes |

99,931 |

4,736 |

70,307 |

4,498 |

|

Neodymium & Praseodymium (NdPr) |

tonnes |

28,514 |

1,248 |

18,546 |

1,190 |

|

Dysprosium (Dy) |

tonnes |

3,420 |

163 |

2,802 |

178 |

|

Terbium (Tb) |

tonnes |

587 |

28 |

479 |

30 |

|

*Be aware: Annual moderate does now not come with the primary yr of ramp-up and the endmost yr of ramp-down |

|

__________________________________ |

|

4 Magnetic REE come with Neodymium (Nd), Praseodymium (Pr), Dysprosium (Dy) and Terbium (Tb). |

Desk 2: Key Mission Monetary Parameters In comparison to Earlier PEA

|

PEA |

Earlier PEA |

||||||

|

Bottom Case (Chinese language Costs) |

Incentive Case (Non-Chinese language Costs) |

Bottom Case (Chinese language Costs) |

|||||

|

Unit |

Overall |

Annual |

Overall |

Annual |

Overall |

Annual |

|

|

Financials |

|||||||

|

Web Earnings |

US$ million |

10,554 |

505 |

13,091 |

626 |

7,355 |

474 |

|

Web Smelter Go back |

US$/t |

52.0 |

– |

64.5 |

– |

49.2 |

– |

|

Basket Worth (2029-2034) |

US$/kg |

88.8 |

– |

104.6 |

– |

107.4 |

– |

|

Basket Worth (LOM) |

US$/kg |

122.4 |

– |

142.8 |

– |

121.2 |

– |

|

Manufacturing Price |

US$ million |

2,757 |

129 |

2,757 |

129 |

1,965 |

125 |

|

Unit Price |

US$/t processed |

13.6 |

– |

13.6 |

– |

13.1 |

– |

|

Unit Price |

US$/kg REO |

27.6 |

– |

27.6 |

– |

27.9 |

|

|

EBITDA |

US$ million |

7,586 |

366 |

10,072 |

485 |

5,243 |

340 |

|

EBITDA Margin |

% |

72 |

– |

77 |

– |

71 |

– |

|

Source of revenue Tax |

US$ million |

2,334 |

118 |

3,172 |

154 |

1,532 |

101 |

|

Efficient Tax Charge |

% |

36.1 |

– |

35.9 |

– |

36.2 |

– |

|

Preliminary Capital |

US$ million |

592.6 |

– |

592.6 |

– |

575.8 |

– |

|

Royalty Acquire Price |

US$ million |

6.5 |

– |

6.5 |

– |

6.5 |

– |

|

Maintaining Capital |

US$ million |

85.8 |

– |

85.8 |

– |

106.2 |

– |

|

Monetary Returns |

|||||||

|

Pre-Tax Web Provide Price (8%) |

US$ million |

2,337 |

– |

3,051 |

– |

1,880 |

– |

|

Pre-Tax Interior Charge of Go back |

% |

32.2 |

– |

40.5 |

– |

35.7 |

– |

|

Publish-Tax Web Provide Price (8%) |

US$ million |

1,483 |

– |

2,159 |

– |

1,186 |

– |

|

Publish-Tax Interior Charge of Go back |

% |

26.5 |

– |

33.1 |

– |

28.6 |

– |

|

Payback Duration |

years |

4.2 |

– |

3.4 |

– |

3.6 |

– |

|

*Be aware: Annual moderate does now not come with the primary yr of ramp-up and the endmost yr of ramp-down |

Sensitivity Research

A sensitivity research used to be undertaken to guage the have an effect on on NPV thru variation of the basket value, cut price fee, CAPEX, OPEX and metallurgical cure charges.

The cut price fee used to be evaluated by means of various its price from 4% to twelve% moment the residue attributes had been evaluated by means of various their values from 80% to 120% (Determine 2).

Mineral Useful resource Remark

The Carina Module’s mineral assets have been estimated the usage of the effects got from 283 auger drill holes (2,101m), 80 opposite movement holes (2,003m) and three,789 samples. At a US$7.4/t NSR cut-off, the Carina Module is estimated to comprise 297.6 million tonnes (“Mt”) within the inferred mineral useful resource division @ 1,452 ppm TREO containing a mean Dy and Tb grade of 39 ppm and six ppm, respectively (Desk 3). The MRE is reported in keeping with the necessities of NI 43-101.

Desk 3. Carina Module Inferred Mineral Useful resource Estimate (Efficient Might 3, 2024)

|

Mineral Classification |

Cluster (Mt) |

Overall Oxide Grade (ppm) |

Oxide Content material (t) |

||||||

|

TREO |

NdPr |

Dy |

Tb |

TREO |

NdPr |

Dy |

Tb |

||

|

Inferred |

297.6 |

1,452 |

284 |

39 |

6 |

432,003 |

84,565 |

11,573 |

1,897 |

|

Overall |

297.6 |

1,452 |

284 |

39 |

6 |

432,003 |

84,565 |

11,573 |

1,897 |

|

Notes: |

|

1. CIM (2014) definitions had been adopted for mineral assets. |

|

2. Mineral assets are estimated above an NSR price of US$7.4/t. |

|

3. Mineral assets are estimated the usage of moderate long run steel costs and metallurgical healings (see PEA for main points). |

|

4. Mineral assets don’t seem to be mineral reserves and should not have demonstrated financial viability. |

Mission Description

The Mission is in response to same old discoverable pit extraction tactics the usage of typical hydraulic excavators and 44t payload haulage vehicles to remove and ship the clays to the method plant. The method plant has been situated alike to the centre of cluster of the mining operation to minimise the entire haulage distance over the week of mine. Given the friable nature of the clays and the shallow intensity of the extraction zones, disagree competitive nor energy-intensive tactics corresponding to drilling and cutting are required to remove the clays from the pits. Desk 4 lists the important thing enter parameters worn within the mine design.

Desk 4: Key Mine Design Parameters

|

Description |

Unit |

Price |

|

Pit Optimization |

||

|

General Slope Attitude |

level |

25 |

|

Reference Mining Price |

US$/t mined |

2.13 |

|

Mining Healing |

% |

98.5 |

|

Mining Dilution |

% |

1.5 |

|

Processing Price |

US$/t processed |

10.46 |

|

Promoting Price |

US$/kg REO |

7.032 |

|

Federal Royalty |

% of earnings |

3 |

|

REO Worth |

US$/kg REO |

variable by means of REO |

|

Pit design |

||

|

Bench Top |

m |

4 |

|

Berm Width |

m |

3.5 |

|

Bench Slope Attitude |

level |

38 |

|

Ramp Width |

m |

12 |

|

Ramp Gradient |

% |

10 |

|

Scheduling |

||

|

Minimal Operational Branch |

m |

25 |

|

Plant feed |

Mt/yr |

9.6 |

As soon as the clay is brought to the method plant, it is going to be washed the usage of an ammonium sulfate technique to remove the REEs from the clay surfaces. Incorrect crushing, grinding nor milling is had to sovereign the REEs from the clays as they’re extracted thru a non-invasive ion-exchange response procedure wherein ammonium sulfate ions change REE ions at the floor of the clay thereby releasing the REEs into resolution. The REEs in resolution are after got rid of thru a pH-adjusted precipitation procedure and after handed thru a high-pressure clear out to take away any residue liquids, to effect the manufacturing of a high-purity REE carbonate in a position for cargo to a judicial separation facility. The method plant may have a mean manufacturing fee of four,736 t/yr of REO inside the concentrates.

Any uninvited impurities corresponding to aluminium and calcium that had been extracted from the clays all the way through the ion replace procedure are in a similar fashion got rid of thru a precipitation procedure and after recombined with the washed clays earlier than being transported to a dried stacking locker facility for the primary 5 years of the week of mine. Starting in yr 6, the washed clays shall be back-filled to the mined-out extraction zones to begin the mine closure procedure.

A aqua cure device built-in into the method plant cleans and regenerates the residue procedure liquors such that they are able to be reintroduced into the feed. The handled aqua is reused in a closed circuit to let fall aqua intake thereby fighting the leave of procedure aqua into the state. This permits the method plant to perform with the minimal of makeup aqua and permits the principle reagents to be regenerated and reused inside the procedure plant.

Earlier than the barren clays proceed the method plant, they are washed with blank aqua inside of same old plate-and-frame clear out presses. This may increasingly take away any residual ammonium sulfate from the clays earlier than they’re returned to both a dried stacking facility or worn to back-fill the extraction zones to be safely worn all the way through revegetation.

The Mission contains the essential infrastructure to handover makeup aqua for the method plant, provide energy to the web site, and handover a street community to carrier the operation, among others.

Electric energy for the processing plant, truck store, management workplaces, and alternative amenities shall be provided by means of the nationwide energy use thru overhead energy transmission traces from a sub-station situated roughly 90 km from the venture web site.

REE Marketplace Outlook and Pricing5

Car electrification, breeze generators and the transition to renewable calories resources will proceed to pressure call for for REEs relating to quantity and, particularly, price. This may increasingly basically impact the REEs worn in alloys to manufacture everlasting magnets (i.e., Dy, Nd, Pr, and Tb). The provision of unpolluted big REEs, particularly Dy, has turn into problematic as a result of few tasks goal big REE deposits. For the medium time period, the marketplace will proceed to depend on China and Myanmar for big REE feedstocks.

The costs of everlasting magnet REEs dropped considerably in 2023 because of a susceptible cure from lockdowns in China and financial demanding situations in alternative disciplines. The costs of Nd, Pr, and Tb fell 40–45% from early 2023 and July 2024. Alternatively, the Dy value outperformed the marketplace, falling simplest 20–25% over the similar duration, indicating a extra constrained provide of Dy as in comparison to alternative everlasting magnet REEs. Argus expects everlasting magnet REE costs to extend often for the residue of the last decade, with the potential for expanding at a quicker fee within the early 2030s absent spare provide from untouched tasks or will increase within the availability of secondary (recycled) REEs. Dy costs are anticipated to proceed to outperform the overall everlasting magnet REE marketplace because of a tighter provide/call for steadiness in the future. Between the years 2023 to 2034, Nd, Pr, and Tb costs are predicted to get up at a fee of five–8% consistent with yr, while Dy costs are anticipated to extend 12% consistent with yr.

In keeping with Argus, there are two exterior components which might have the prospective to undoubtedly impact era REE costs: so-called ‘inexperienced’ premiums; and significant subject material insurance policies (in particular inside of Europe and america). Vital fabrics insurance policies and rules being enacted globally, particularly the Ecu Vital Uncooked Fabrics Work and america Inflation Aid Work, are focussed on developing uncooked subject material provide chains that don’t seem to be reliant on China, which might handover benefits to non-Chinese language providers of REEs relating to marketplace get admission to and, probably, pricing premiums. In Might 2023, america Branch of Power recognized Dy as essentially the most essential mineral relating to its utility to the calories sector and the dangers of provide chain disruption.

In an struggle to account for essential uncooked subject material rules, Argus has modelled an incentive value for magnetic uncommon earths, the place the uncommon earths marketplace successfully has a twin pricing type (Chinese language and non-Chinese language) that forecasts the extent that REE costs must succeed in to incentivize the provision of REE from manufacturers outdoor of China. Beneath the motivation value state of affairs, the ahead curve for Dy grows at 15% consistent with yr, in comparison to 12% consistent with yr within the bottom case state of affairs (Desk 5).

Desk 5: Dysprosium Worth Forecast

|

2022 |

2023 |

2028 |

2034 |

2023 vs 2022 |

2028 vs 2023 |

2034 vs 2028 |

CAGR 2023– |

|

|

Dy |

||||||||

|

Bottom Case Worth* (US$/kg) |

384 |

331 |

595 |

1,100 |

–14 |

80 |

85 |

12 |

|

Incentive Worth (US$/kg) |

384 |

331 |

515 |

1,400 |

–14 |

56 |

170 |

15 |

|

Overall provide (×1,000 t REO) |

1.7 |

2.6 |

3.6 |

4.4 |

50 |

39 |

23 |

5 |

|

Overall call for (×1,000 t REO) |

2.8 |

3.3 |

5.3 |

7.0 |

16 |

62 |

32 |

7 |

|

Surplus/inadequency index (2018 = 100) |

98 |

96 |

77 |

43 |

– |

– |

– |

– |

|

*99.5–99.9% fob China |

Please see supplies an instance of illustrating the prospective decoupling of uncommon earths costs between the ones sourced from and outdoor of China, modelled the usage of gallium, germanium and antimony. In September 2024, China shall be including antimony to its export controls for sure metals (along with gallium and germanium, which have been made topic to its export controls in August 2023). US-delivered costs for antimony have higher roughly 25% as in comparison to costs for antimony sourced from China, moment costs for gallium and germanium sourced on an ex-works China foundation have mirrored a possible top class of as much as 85% in terms of gallium (lately a top class of 45%) and as much as 25% in terms of germanium (lately a top class of 10%) (Determine 3). The motivation pricing state of affairs seeks to emulate a status the place the principle economies corresponding to america, Europe and Japan are required to offer uncommon earths outdoor of China supported by means of essential fabrics insurance policies/rules being enacted in such international locations.

|

_______________________________ |

|

5 Argus Media |

In attention of the fee forecasts equipped by means of Argus, the basket value of the Carina Mission has been modelled during the week of mine, reflecting anticipated industrial reductions (Determine 4 and Determine 5).

Centered Building Timeline

The allowing procedure is lately underway and the technical advancement of the Mission will proceed with a feasibility learn about of the Carina Module scheduled to be delivered in 2026 and graduation of operations projected to start in 2029 (Desk 6). Following the Memorandum of Working out signed with the Executive of Goiás and the Municipality of Nova Roma, the Corporate is comparing the likelihood to expedite the manufacturing time table to start between 2027 and 2028.

Proposed Later Steps

- Continuation of the Carina Module pre-feasibility learn about as prior to now reported within the Corporate’s press leave dated Might 6, 2024

- Finishing touch of a 15,200m Section 2 opposite movement drill marketing campaign geared toward changing inferred mineral assets to a steady and indicated mineral assets division, which is predicted to be finished by means of This autumn 2024

- Finishing touch of the environmental and social baseline research required for environmental allowing procedure all the way through H2 2024

- Execution of a metallurgical take a look at marketing campaign all the way through H2 2024 and H1 2025 with pattern collections to be got thru sonic drilling and despatched to SGS Lakefield for mineralogical and cure characterization, to lend as spare inputs for the Carina Module prefeasibility learn about and to method the foundation for a untouched piloting operation

- The Corporate is aiming to finish the set up and operation of a untouched semi-industrial scale pilot plant within the Order of Goias, Brazil all the way through Q2 2025. The piloting operation is meant to (i) ascertain the processing parameters and the general procedure flowsheet design for the feasibility learn about, (ii) generate a grand purity HREE carbonate for judicial separation trials in backup of era off-take words, and (iii) display to related stakeholders the environmental sustainability of the general procedure design

Certified Particular persons

The technical knowledge on this press leave has been reviewed and licensed by means of geologist Fábio Xavier, mining engineer Porfírio Cabaleiro Rodriguez, geographer and environmental analyst Mrs. Branca Horta of GE21 Consultoria Mineral Ltd., in addition to Chemical Engineer Stuart J Saich of Promet101 Consulting Pty Ltd. GE21 is a specialised, free mineral consulting corporate founded in Belo Horizonte, Brazil, and Promet101 is an free procedure engineering consulting corporate founded in Santiago, Chile. Mr. Jorge Frutuoso, Aclara Geology Supervisor, and Mr. Juan Pablo Navarro Ramirez, Important Geologist for Aclara, acted because the Certified Particular person for the geological categories of the document.

Mr. Xavier is a Member of Australian Institute of Geoscientists (MAIG #5179) and is a Certified Particular person as outlined beneath NI 43-101. He’s liable for the mineral useful resource estimate and has reviewed and licensed the medical and technical knowledge indistinguishable to the mineral useful resource estimate contained on this press leave.

Mr. Rodriguez is a fellow of the Australian Institute of Geoscientists (FAIG #3708) and is a Certified Particular person as outlined beneath NI 43-101. He has greater than 40 years of enjoy in mineral useful resource/conserve estimation and is the chief of the Mission performing as general manager with recognize to the targets of the File.

Mrs. Horta is a Member of the Australian Institute of Geoscientists (MAIG #8145) and is a Certified Particular person as outlined beneath NI 43-101. She has reviewed and licensed the content material of the File because it pertains to environmental and allowing attributes of the Mission.

Messrs. Rodriguez and Xavier visited the venture from August 16 to August 18, 2023, all the way through the auger drilling marketing campaign accomplished by means of the GE21 crew beneath the coordination of Geologist André Costa (FAIG#7967). Mr. Xavier returned to the venture from July 17 to July 18, 2024, all the way through the opposite movement drilling marketing campaign carried out by means of the Aclara crew beneath the coordination of Geologist Luiz Jorge Frutuoso Young (FAIG#8100).

Mr. Frutuoso Young, Aclara’s Exploration Supervisor, supported each visits.Mr. Saich is a qualified chemical engineer with greater than 37 years’ related enjoy in metallurgy and procedure design advancement. He’s with a member of the Australian Institute of Mining and Metallurgy (FAUSIMM, (#222028), the Canadian Institute of Mining (CIM # 631368), the Folk for Mining, Exploration & Metallurgy (SME# 04101270) and is a Certified Particular person as outlined beneath NI 43-101.

Mr. Frutuoso is a Fellow of Australian Institute of Geoscientists (FAIG #8100) and Fellow of Australasian Institute of Mining and Metallurgy (FAusIMM #3044851) is a Certified Particular person as outlined beneath NI 43-101. He’s liable for the geological categories and has reviewed and licensed the medical and technical knowledge indistinguishable to the mineral useful resource estimate contained on this press leave.

Mr. Navarro is a Member of Australian Institute of Geoscientists (MAIG #9021) and is a Certified Particular person as outlined beneath NI 43-101. He’s liable for the geological categories and has reviewed and licensed the medical and technical knowledge indistinguishable to the mineral useful resource estimate contained on this press leave.

About Aclara

Aclara Sources Inc. (TSX: ARA) is a development-stage corporate that specializes in big uncommon earth mineral assets hosted in Ion-Adsorption Clay deposits. The Corporate’s uncommon earth mineral useful resource advancement tasks come with the Carina Module within the Order of Goiás, Brazil as its flagship venture and the Penco Module within the Bio-Bio Patch of Chile.

Aclara’s uncommon earth extraction procedure deals a number of environmentally horny options. Round mineral harvesting does now not contain cutting, crushing, or milling, and subsequently does now not generate tailings and gets rid of the will for a tailing’s locker facility. The extraction procedure evolved by means of Aclara minimizes aqua intake thru grand ranges of aqua recirculation made imaginable by means of the inclusion of a aqua remedy facility inside of its patented procedure design. The ionic clay feedstock is amenable to leaching with a ordinary fertilizer primary reagent, ammonium sulfate. Along with the advance of the Penco Module and the Carina Module, the Corporate will proceed to spot and overview alternatives to extend era manufacturing of big uncommon earths thru greenfield exploration methods and the advance of spare tasks inside the Corporate’s stream concessions in Brazil, Chile, and Peru.

Aclara has determined to vertically combine its uncommon earths pay attention manufacturing in opposition to the producing of uncommon earths alloys. The Corporate has established a U.S.-based subsidiary, Aclara Applied sciences Inc., which can focal point on creating applied sciences for uncommon earth judicial separation, metals, and alloys. Moreover, the Corporate is advancing its metals and alloys trade thru a three way partnership with CAP S.A., leveraging CAP’s intensive experience in steel refining and particular ferro-alloyed steels.

Ahead-Taking a look Statements

This press leave incorporates “forward-looking information” inside the which means of acceptable securities regulation, which displays the Corporate’s stream expectancies relating to era occasions, together with statements with reference to, amongst alternative issues, mineral perpetuity, grade, technique, advancement timeline, manufacturing timing and upside on the Carina Module, the Corporate’s exploration plan, drilling campaigns and actions in Brazil and the expectancies of the Corporate’s control as to the result of such exploration works and drilling actions, timing, price and scope in recognize of the exploration actions in Brazil, the effects and interpretations of its up to date maiden MRE and the PEA on the subject of the Carina Module, the timing and issuance of a prefeasibility learn about and feasibility learn about for the Carina Module and indistinguishable exploration and alternative paintings methods in recognize thereof, the forming and timing of environmental, archeological and geological research for the Carina Module, the development of and pricing forecast of the REE marketplace, and alternative statements that don’t seem to be subject material information. Ahead-looking knowledge is in response to numerous guesses and is topic to numerous dangers and uncertainties, a lot of which can be past the Corporate’s keep an eye on. Such dangers and uncertainties come with, however don’t seem to be restricted to dangers indistinguishable to working in a overseas jurisdiction, together with political and financial dangers in Chile and Brazil; dangers indistinguishable to adjustments to mining regulations and rules and the termination or non-renewal of mining rights by means of governmental government; dangers indistinguishable to failure to agree to the regulation or download essential lets in and licenses or renew them; price of compliance with acceptable environmental rules; latest manufacturing, capital and working prices could also be other than the ones expected; the Corporate could also be now not in a position to effectively whole the advance, building and start-up of mines and untouched advancement tasks; dangers indistinguishable to fluctuation in commodity costs; dangers indistinguishable to mining operations; and dependence at the Penco Module and/or the Carina Module. Aclara cautions that the foregoing record of things isn’t exhaustive. For an in depth dialogue of the foregoing components, amongst others, please the following the danger components mentioned beneath “Risk Factors” within the Corporate’s annual knowledge method dated as of March 22, 2024, filed at the Corporate’s SEDAR+ profile. Latest effects and timing may range materially from the ones projected herein. Until differently famous or the context differently signifies, the forward-looking knowledge contained on this press leave is equipped as of the era of this press leave and the Corporate does now not adopt any legal responsibility to replace such forward-looking knowledge, whether or not because of untouched knowledge, era occasions or differently, aside from as expressly required beneath acceptable securities regulations.

SOURCE Aclara Sources Inc.