- Earnings $12.9 billion, up 10.6% from year-ago quarter

- Diluted EPS $3.88, up 15.8% from year-ago quarter

- $2.1 billion money from running actions, 199% of internet profits

- Very robust form process in all 4 departments

RESTON, Va., Oct. 24, 2025 /PRNewswire/ — Common Dynamics (NYSE: GD) nowadays reported third-quarter 2025 running profits of $1.3 billion, or $3.88 in line with diluted percentage (EPS), on earnings of $12.9 billion. When put next with the year-ago quarter, earnings greater 10.6%, running profits greater 12.7%, and diluted EPS greater 15.8%. Running margin of 10.3% used to be a 20-basis-point growth from the year-ago quarter and a 30-basis-point growth sequentially.

“Each of our four segments grew earnings and backlog in the quarter, reflecting solid execution coupled with growing demand,” stated Phebe Novakovic, chairman and government officer. “The Aerospace segment in particular performed impressively, growing revenue 30.3% and expanding margins by 100 basis points from the same period a year ago, with order activity for business jets remaining very strong.”

Money and Capital Deployment

Web money equipped by way of running actions within the quarter totaled $2.1 billion, or 199% of internet profits. All the way through the quarter, the corporate paid $403 million in dividends and invested $212 million in capital expenditures, finishing the quarter with $8 billion in overall debt and $2.5 billion in money and equivalents readily available.

Orders and Backlog

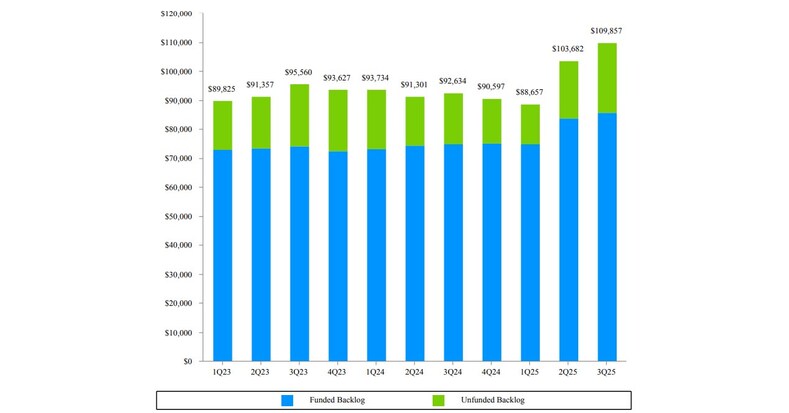

Orders totaled $19.3 billion within the quarter on a companywide foundation. Consolidated book-to-bill ratio, outlined as orders divided by way of earnings, used to be 1.5-to-1 for the quarter. Hold-to-bill used to be 1.6-to-1 for the protection departments and 1.3-to-1 for the Aerospace section.

Overall estimated pledge price, the sum of all backlog elements, used to be $167.7 billion on the finish of the quarter. This contains backlog of $109.9 billion and estimated attainable pledge price, representing control’s estimate of backup price in unfunded indefinite supply, indefinite bundle (IDIQ) oaths and unexercised choices, of $57.8 billion.

About Common Dynamics

Headquartered in Reston, Virginia, Common Dynamics is an international aerospace and protection corporate that do business in a huge portfolio of services and products in industry flight; send building and service; land fight cars, guns methods and munitions; and generation services and products. Common Dynamics employs greater than 110,000 family international and generated $47.7 billion in earnings in 2024. Additional information is to be had at www.gd.com.

WEBCAST INFORMATION: Common Dynamics will webcast its third-quarter 2025 monetary effects convention name at 9 a.m. EDT on Friday, October 24, 2025. The webcast can be a listen-only audio match to be had at www.gd.com. An on-demand replay of the webcast can be to be had by way of phone two hours then the tip of the decision thru October 31, 2025, at 800-770-2030 (world: +1 609-800-9909), convention ID 4299949. Charts furnished to traders and securities analysts in reference to Common Dynamics’ announcement of its monetary effects are to be had at www.gd.com.

This press loose accommodates forward-looking statements (FLS), together with statements in regards to the corporate’s generation operational and monetary efficiency, which can be according to control’s expectancies, estimates, projections and suppositions. Phrases comparable to “expects,” “anticipates,” “plans,” “believes,” “forecasts,” “scheduled,” “outlook,” “estimates,” “should” and permutations of those phrases and indistinguishable expressions are meant to spot FLS. In making FLS, we depend on suppositions and analyses according to our enjoy and belief of historic developments; tide statuses and anticipated generation traits; and alternative components, estimates and judgments we imagine affordable and suitable according to knowledge to be had to us on the life. FLS are made pursuant to the preserve harbor provisions of the Non-public Securities Litigation Reform Business of 1995, as amended. FLS don’t seem to be promises of generation efficiency and contain components, dangers and uncertainties which can be tricky to are expecting. Latest generation effects and developments might fluctuate materially from what’s forecast within the FLS. All FLS discuss solely as of the life they had been made. We don’t adopt any legal responsibility to replace or publicly loose revisions to FLS to replicate occasions, instances or adjustments in expectancies then the life of this press loose. Extra knowledge referring to those components is contained within the corporate’s filings with the SEC, and those components could also be revised or supplemented in generation SEC filings. As well as, this press loose accommodates some monetary measures no longer ready based on U.S. usually approved accounting rules (GAAP). Year we imagine those non-GAAP metrics grant helpful knowledge for traders, there are boundaries related to their importance, and our calculations of those metrics might not be related to in a similar fashion titled measures of alternative firms. Non-GAAP metrics will have to no longer be regarded as in isolation from, or as an alternative to, GAAP measures. Reconciliations to related GAAP measures and alternative knowledge in terms of our non-GAAP measures are incorporated in alternative filings with the SEC, which can be to be had at investorrelations.gd.com.

|

EXHIBIT A CONSOLIDATED STATEMENT OF EARNINGS – (UNAUDITED) DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

|

|||||||||

| |

|

|||||||||

| |

3 Months Ended |

|

Variance |

|

||||||

| |

September 28, 2025 |

|

September 29, 2024 |

|

$ |

|

|

% |

|

|

|

Earnings |

$ 12,907 |

|

$ 11,671 |

|

$ 1,236 |

|

|

|

10.6 % |

|

|

Running prices and bills |

(11,576) |

|

(10,490) |

|

(1,086) |

|

|

|

|

|

|

Running profits |

1,331 |

|

1,181 |

|

150 |

|

|

|

12.7 % |

|

|

Alternative, internet |

15 |

|

15 |

|

— |

|

|

|

|

|

|

Pastime, internet |

(74) |

|

(82) |

|

8 |

|

|

|

|

|

|

Profits sooner than source of revenue tax |

1,272 |

|

1,114 |

|

158 |

|

|

|

14.2 % |

|

|

Provision for source of revenue tax, internet |

(213) |

|

(184) |

|

(29) |

|

|

|

|

|

|

Web profits |

$ 1,059 |

|

$ 930 |

|

$ 129 |

|

|

|

13.9 % |

|

|

Profits in line with percentage—modest |

$ 3.93 |

|

$ 3.39 |

|

$ 0.54 |

|

|

|

15.9 % |

|

|

Modest weighted reasonable stocks exceptional |

269.2 |

|

274.4 |

|

|

|

|

|

|

|

|

Profits in line with percentage—diluted |

$ 3.88 |

|

$ 3.35 |

|

$ 0.53 |

|

|

|

15.8 % |

|

|

Diluted weighted reasonable stocks exceptional |

272.6 |

|

277.9 |

|

|

|

|

|

|

|

|

EXHIBIT B CONSOLIDATED STATEMENT OF EARNINGS – (UNAUDITED) DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

|

|||||||||

| |

|

|||||||||

| |

9 Months Ended |

|

Variance |

|

||||||

| |

September 28, 2025 |

|

September 29, 2024 |

|

$ |

|

|

% |

|

|

|

Earnings |

$ 38,171 |

|

$ 34,378 |

|

$ 3,793 |

|

|

|

11.0 % |

|

|

Running prices and bills |

(34,267) |

|

(31,005) |

|

(3,262) |

|

|

|

|

|

|

Running profits |

3,904 |

|

3,373 |

|

531 |

|

|

|

15.7 % |

|

|

Alternative, internet |

51 |

|

47 |

|

4 |

|

|

|

|

|

|

Pastime, internet |

(251) |

|

(248) |

|

(3) |

|

|

|

|

|

|

Profits sooner than source of revenue tax |

3,704 |

|

3,172 |

|

532 |

|

|

|

16.8 % |

|

|

Provision for source of revenue tax, internet |

(637) |

|

(538) |

|

(99) |

|

|

|

|

|

|

Web profits |

$ 3,067 |

|

$ 2,634 |

|

$ 433 |

|

|

|

16.4 % |

|

|

Profits in line with percentage—modest |

$ 11.41 |

|

$ 9.61 |

|

$ 1.80 |

|

|

|

18.7 % |

|

|

Modest weighted reasonable stocks exceptional |

268.8 |

|

274.0 |

|

|

|

|

|

|

|

|

Profits in line with percentage—diluted |

$ 11.29 |

|

$ 9.49 |

|

$ 1.80 |

|

|

|

19.0 % |

|

|

Diluted weighted reasonable stocks exceptional |

271.8 |

|

277.5 |

|

|

|

|

|

|

|

|

EXHIBIT C REVENUE AND OPERATING EARNINGS BY SEGMENT – (UNAUDITED) DOLLARS IN MILLIONS |

|

|||||||||

| |

|

|||||||||

| |

3 Months Ended |

|

Variance |

|

||||||

| |

September 28, 2025 |

|

September 29, 2024 |

|

$ |

|

|

% |

|

|

|

Earnings: |

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

$ 3,234 |

|

$ 2,482 |

|

$ 752 |

|

|

|

30.3 % |

|

|

Marine Programs |

4,096 |

|

3,599 |

|

497 |

|

|

|

13.8 % |

|

|

Battle Programs |

2,252 |

|

2,212 |

|

40 |

|

|

|

1.8 % |

|

|

Applied sciences |

3,325 |

|

3,378 |

|

(53) |

|

|

|

(1.6) % |

|

|

Overall |

$ 12,907 |

|

$ 11,671 |

|

$ 1,236 |

|

|

|

10.6 % |

|

|

Running profits: |

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

$430 |

|

$ 305 |

|

$ 125 |

|

|

|

41.0 % |

|

|

Marine Programs |

291 |

|

258 |

|

33 |

|

|

|

12.8 % |

|

|

Battle Programs |

335 |

|

325 |

|

10 |

|

|

|

3.1 % |

|

|

Applied sciences |

327 |

|

326 |

|

1 |

|

|

|

0.3 % |

|

|

Company |

(52) |

|

(33) |

|

(19) |

|

|

|

(57.6) % |

|

|

Overall |

$ 1,331 |

|

$ 1,181 |

|

$ 150 |

|

|

|

12.7 % |

|

|

Running margin: |

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

13.3 % |

|

12.3 % |

|

|

|

|

|

|

|

|

Marine Programs |

7.1 % |

|

7.2 % |

|

|

|

|

|

|

|

|

Battle Programs |

14.9 % |

|

14.7 % |

|

|

|

|

|

|

|

|

Applied sciences |

9.8 % |

|

9.7 % |

|

|

|

|

|

|

|

|

Overall |

10.3 % |

|

10.1 % |

|

|

|

|

|

|

|

|

EXHIBIT D REVENUE AND OPERATING EARNINGS BY SEGMENT – (UNAUDITED) DOLLARS IN MILLIONS |

|

|||||||||

| |

|

|||||||||

| |

9 Months Ended |

|

Variance |

|

||||||

| |

September 28, 2025 |

|

September 29, 2024 |

|

$ |

|

|

% |

|

|

|

Earnings: |

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

$ 9,322 |

|

$ 7,506 |

|

$ 1,816 |

|

|

|

24.2 % |

|

|

Marine Programs |

11,905 |

|

10,383 |

|

1,522 |

|

|

|

14.7 % |

|

|

Battle Programs |

6,711 |

|

6,602 |

|

109 |

|

|

|

1.7 % |

|

|

Applied sciences |

10,233 |

|

9,887 |

|

346 |

|

|

|

3.5 % |

|

|

Overall |

$ 38,171 |

|

$ 34,378 |

|

$ 3,793 |

|

|

|

11.0 % |

|

|

Running profits: |

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

$ 1,265 |

|

$ 879 |

|

$ 386 |

|

|

|

43.9 % |

|

|

Marine Programs |

832 |

|

735 |

|

97 |

|

|

|

13.2 % |

|

|

Battle Programs |

950 |

|

920 |

|

30 |

|

|

|

3.3 % |

|

|

Applied sciences |

987 |

|

941 |

|

46 |

|

|

|

4.9 % |

|

|

Company |

(130) |

|

(102) |

|

(28) |

|

|

|

(27.5) % |

|

|

Overall |

$ 3,904 |

|

$ 3,373 |

|

$ 531 |

|

|

|

15.7 % |

|

|

Running margin: |

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

13.6 % |

|

11.7 % |

|

|

|

|

|

|

|

|

Marine Programs |

7.0 % |

|

7.1 % |

|

|

|

|

|

|

|

|

Battle Programs |

14.2 % |

|

13.9 % |

|

|

|

|

|

|

|

|

Applied sciences |

9.6 % |

|

9.5 % |

|

|

|

|

|

|

|

|

Overall |

10.2 % |

|

9.8 % |

|

|

|

|

|

|

|

|

EXHIBIT E CONSOLIDATED BALANCE SHEET DOLLARS IN MILLIONS |

|||

| |

|||

| |

(Unaudited) |

|

|

| |

September 28, 2025 |

|

December 31, 2024 |

|

ASSETS |

|

|

|

|

Flow belongings: |

|

|

|

|

Money and equivalents |

$ 2,520 |

|

$ 1,697 |

|

Accounts receivable |

3,303 |

|

2,977 |

|

Unbilled receivables |

8,641 |

|

8,248 |

|

Inventories |

9,813 |

|

9,724 |

|

Alternative tide belongings |

1,575 |

|

1,740 |

|

Overall tide belongings |

25,852 |

|

24,386 |

|

Noncurrent belongings: |

|

|

|

|

Feature, plant and kit, internet |

6,602 |

|

6,467 |

|

Intangible belongings, internet |

1,402 |

|

1,520 |

|

Commendation |

20,871 |

|

20,556 |

|

Alternative belongings |

2,872 |

|

2,951 |

|

Overall noncurrent belongings |

31,747 |

|

31,494 |

|

Overall belongings |

$ 57,599 |

|

$ 55,880 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

Flow liabilities: |

|

|

|

|

Scale down-term debt and tide portion of long-term debt |

$ 1,006 |

|

$ 1,502 |

|

Accounts payable |

3,459 |

|

3,344 |

|

Buyer advances and deposits |

10,462 |

|

9,491 |

|

Alternative tide liabilities |

3,537 |

|

3,487 |

|

Overall tide liabilities |

18,464 |

|

17,824 |

|

Noncurrent liabilities: |

|

|

|

|

Lengthy-term debt |

7,008 |

|

7,260 |

|

Alternative liabilities |

7,693 |

|

8,733 |

|

Overall noncurrent liabilities |

14,701 |

|

15,993 |

|

Shareholders’ fairness: |

|

|

|

|

Familiar conserve |

482 |

|

482 |

|

Surplus |

4,323 |

|

4,062 |

|

Retained profits |

43,345 |

|

41,487 |

|

Treasury conserve |

(22,856) |

|

(22,450) |

|

Gathered alternative complete loss |

(860) |

|

(1,518) |

|

Overall shareholders’ fairness |

24,434 |

|

22,063 |

|

Overall liabilities and shareholders’ fairness |

$ 57,599 |

|

$ 55,880 |

|

EXHIBIT F CONSOLIDATED STATEMENT OF CASH FLOWS – (UNAUDITED) DOLLARS IN MILLIONS |

|||

| |

|||

| |

9 Months Ended |

||

| |

September 28, 2025 |

|

September 29, 2024 |

|

Money flows from running actions—proceeding operations: |

|

|

|

|

Web profits |

$ 3,067 |

|

$ 2,634 |

|

Changes to reconcile internet profits to internet money from running actions: |

|

|

|

|

Depreciation of constituent, plant and kit |

490 |

|

469 |

|

Amortization of intangible and finance hire right-of-use belongings |

182 |

|

177 |

|

Fairness-based reimbursement expense |

146 |

|

137 |

|

Deferred source of revenue tax provision (get advantages) |

151 |

|

(107) |

|

(Build up) scale down in belongings, internet of results of commercial acquisitions: |

|

|

|

|

Accounts receivable |

(314) |

|

(172) |

|

Unbilled receivables |

(415) |

|

(874) |

|

Inventories |

(131) |

|

(1,612) |

|

Build up (scale down) in liabilities, internet of results of commercial acquisitions: |

|

|

|

|

Accounts payable |

119 |

|

193 |

|

Buyer advances and deposits |

45 |

|

628 |

|

Alternative, internet |

219 |

|

479 |

|

Web money equipped by way of running actions |

3,559 |

|

1,952 |

|

Money flows from making an investment actions: |

|

|

|

|

Capital expenditures |

(552) |

|

(561) |

|

Alternative, internet |

130 |

|

(27) |

|

Web money impaired by way of making an investment actions |

(422) |

|

(588) |

|

Money flows from financing actions: |

|

|

|

|

Compensation of fixed-rate notes |

(1,500) |

|

— |

|

Proceeds from fixed-rate notes |

747 |

|

— |

|

Dividends paid |

(1,188) |

|

(1,140) |

|

Purchases of regular conserve |

(600) |

|

(183) |

|

Alternative, internet |

235 |

|

150 |

|

Web money impaired by way of financing actions |

(2,306) |

|

(1,173) |

|

Web money impaired by way of discontinued operations |

(8) |

|

(3) |

|

Web build up in money and equivalents |

823 |

|

188 |

|

Money and equivalents at starting of duration |

1,697 |

|

1,913 |

|

Money and equivalents at finish of duration |

$ 2,520 |

|

$ 2,101 |

|

EXHIBIT G ADDITIONAL FINANCIAL INFORMATION – (UNAUDITED) DOLLARS IN MILLIONS, EXCEPT PER SHARE AMOUNTS |

|||||||

| |

|||||||

|

Alternative Monetary Data: |

|

|

|

|

|

|

|

| |

September 28, 2025 |

|

December 31, 2024 |

|

|

|

|

|

Debt-to-equity (a) |

32.8 % |

|

39.7 % |

|

|

|

|

|

Hold price in line with percentage (b) |

$ 90.46 |

|

$ 81.61 |

|

|

|

|

|

Stocks exceptional |

270,120,442 |

|

270,340,502 |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

3rd Quarter |

|

9 Months |

||||

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

|

Source of revenue tax bills, internet |

$ 27 |

|

$ 173 |

|

$ 263 |

|

$ 125 |

|

Corporate-sponsored analysis and advancement (c) |

$ 119 |

|

$ 137 |

|

$ 339 |

|

$ 421 |

|

Go back on gross sales (d) |

8.2 % |

|

8.0 % |

|

8.0 % |

|

7.7 % |

| |

|

|

|

|

|

|

|

|

Non-GAAP Monetary Measures: |

|

|

|

|

|

|

|

| |

3rd Quarter |

|

9 Months |

||||

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

|

Sovereign money tide: |

|

|

|

|

|

|

|

|

Web money equipped by way of running actions |

$ 2,109 |

|

$ 1,416 |

|

$ 3,559 |

|

$ 1,952 |

|

Capital expenditures |

(212) |

|

(201) |

|

(552) |

|

(561) |

|

Sovereign money tide (e) |

$ 1,897 |

|

$ 1,215 |

|

$ 3,007 |

|

$ 1,391 |

| |

|

|

|

|

|

|

|

| |

September 28, 2025 |

|

December 31, 2024 |

|

|

|

|

|

Web debt: |

|

|

|

|

|

|

|

|

Overall debt |

$ 8,014 |

|

$ 8,762 |

|

|

|

|

|

Much less money and equivalents |

2,520 |

|

1,697 |

|

|

|

|

|

Web debt (f) |

$ 5,494 |

|

$ 7,065 |

|

|

|

|

|

(a) |

Debt-to-equity ratio is calculated as overall debt divided by way of overall fairness as of the tip of the duration. |

|

(b) |

Hold price in line with percentage is calculated as overall fairness divided by way of overall exceptional stocks as of the tip of the duration. |

|

(c) |

Contains isolated analysis and advancement and Aerospace product-development prices. |

|

(d) |

Go back on gross sales is calculated as internet profits divided by way of earnings. |

|

(e) |

We outline distant money tide as internet money from running actions much less capital expenditures. We imagine distant money tide is an invaluable measure for traders as it portrays our skill to generate money from our companies for functions comparable to repaying debt, investment industry acquisitions, repurchasing our regular conserve and paying dividends. We importance distant money tide to evaluate the feature of our profits and as a key efficiency measure in comparing control. |

|

(f) |

We outline internet debt as short- and long-term debt (overall debt) much less money and equivalents. We imagine internet debt is an invaluable measure for traders as a result of it displays the borrowings that backup our operations and capital deployment technique. We importance internet debt as an remarkable indicator of liquidity and monetary place. |

|

EXHIBIT H BACKLOG – (UNAUDITED) DOLLARS IN MILLIONS |

||||||||||

| |

||||||||||

| |

|

Funded |

|

Unfunded |

|

Overall Backlog |

|

Estimated Doable Word Price* |

|

Overall Estimated Word Price |

|

3rd Quarter 2025: |

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

|

$ 19,476 |

|

$ 1,131 |

|

$ 20,607 |

|

$ 1,147 |

|

$ 21,754 |

|

Marine Programs |

|

38,757 |

|

14,854 |

|

53,611 |

|

14,839 |

|

68,450 |

|

Battle Programs |

|

17,232 |

|

1,470 |

|

18,702 |

|

9,553 |

|

28,255 |

|

Applied sciences |

|

10,269 |

|

6,668 |

|

16,937 |

|

32,341 |

|

49,278 |

|

Overall |

|

$ 85,734 |

|

$ 24,123 |

|

$ 109,857 |

|

$ 57,880 |

|

$ 167,737 |

|

2nd Quarter 2025: |

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

|

$ 18,676 |

|

$ 1,227 |

|

$ 19,903 |

|

$ 1,165 |

|

$ 21,068 |

|

Marine Programs |

|

39,298 |

|

13,674 |

|

52,972 |

|

14,708 |

|

67,680 |

|

Battle Programs |

|

15,961 |

|

616 |

|

16,577 |

|

9,592 |

|

26,169 |

|

Applied sciences |

|

9,945 |

|

4,285 |

|

14,230 |

|

32,011 |

|

46,241 |

|

Overall |

|

$ 83,880 |

|

$ 19,802 |

|

$ 103,682 |

|

$ 57,476 |

|

$ 161,158 |

|

3rd Quarter 2024: |

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

|

$ 18,859 |

|

$ 937 |

|

$ 19,796 |

|

$ 254 |

|

$ 20,050 |

|

Marine Programs |

|

29,008 |

|

11,463 |

|

40,471 |

|

9,578 |

|

50,049 |

|

Battle Programs |

|

17,289 |

|

682 |

|

17,971 |

|

8,016 |

|

25,987 |

|

Applied sciences |

|

9,794 |

|

4,602 |

|

14,396 |

|

27,093 |

|

41,489 |

|

Overall |

|

$ 74,950 |

|

$ 17,684 |

|

$ 92,634 |

|

$ 44,941 |

|

$ 137,575 |

|

* |

The estimated attainable pledge price contains paintings awarded on unfunded indefinite supply, indefinite bundle (IDIQ) oaths and unexercised choices related to current company oaths, together with choices and alternative word of honour with current consumers to buy brandnew airplane and airplane products and services. We acknowledge choices in backlog when the client workout routines the choice and establishes a company form. For IDIQ oaths, we assessment the volume of investment we think to obtain and come with this quantity in our estimated attainable pledge price. The latest quantity of investment won going forward could also be upper or less than our estimate of attainable pledge price. |

|

EXHIBIT H-1 |

|

EXHIBIT H-2 |

|

EXHIBIT I AEROSPACE SUPPLEMENTAL DATA – (UNAUDITED) DOLLARS IN MILLIONS |

||||||||

| |

||||||||

| |

|

3rd Quarter |

9 Months |

|||||

| |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

Gulfstream Airplane Deliveries (gadgets): |

|

|

|

|

|

|

|

|

|

Immense-cabin airplane |

|

33 |

|

24 |

|

95 |

|

76 |

|

Mid-cabin airplane |

|

6 |

|

4 |

|

18 |

|

13 |

|

Overall |

|

39 |

|

28 |

|

113 |

|

89 |

| |

|

|

|

|

|

|

|

|

|

Aerospace Hold-to-Invoice: |

|

|

|

|

|

|

|

|

|

Orders* |

|

$ 4,053 |

|

$ 2,365 |

|

$ 10,417 |

|

$ 7,464 |

|

Earnings |

|

3,234 |

|

2,482 |

|

9,322 |

|

7,506 |

|

Hold-to-Invoice Ratio |

|

1.3x |

|

1.0x |

|

1.1x |

|

1.0x |

| |

||||||||

|

* Does no longer come with buyer defaults, liquidated damages, cancellations, foreign currency fluctuations and alternative backlog changes. |

||||||||

SOURCE Common Dynamics