Inside the broader worn truck and trailer markets, “day cabs currently have the toughest market,” says Truck Paper Supervisor Scott Lubischer. “Inventory aging continues to increase, and we urge dealers who have not made price adjustments to adjust their prices accordingly to reflect the current market.”

Talking in regards to the worn farm apparatus marketplace, TractorHouse Supervisor Ryan Dolezal explains, “With the end of the year approaching, sales are starting to tick up, leading to some optimism for the end of the year. However, sales are slower compared to past years, so it’s still vital to price competitively.”

The important thing metric in all of Sandhills’ marketplace reviews is the Sandhills Apparatus Price Index (EVI). Patrons and dealers can significance the ideas within the Sandhills EVI to observe apparatus markets and maximize returns on acquisition, liquidation, and homogeneous industry choices. The Sandhills EVI knowledge come with apparatus to be had in public sale and retail markets and model-year apparatus actively in significance. EVI unfold measures the share extra between asking and public sale values.

Marketplace Document Main points

Sandhills marketplace reviews spotlight essentially the most significant modifications in Sandhills’ worn heavy-duty truck, semi-trailer, farm equipment, and development apparatus markets. Key issues from the flow reviews are indexed beneath. Complete reviews are to be had upon request.

U.S. Old Weighty-Accountability Vans

- Stock ranges on this marketplace lowered by way of 3.63% hour over hour and 11.84% 12 months over 12 months in November and are trending indisposed. The steepest stock release came about within the worn time cab truck division, which used to be indisposed 9.97% M/M and 22.64% YOY.

- Asking values lowered by way of 1.54% M/M and remained virtually flat in comparison to year-ago values with a nil.08% short. The worn sleeper truck division lowered essentially the most M/M, by way of 2%, week the worn time cab truck division lowered essentially the most YOY, by way of 6.28%. Asking values are recently trending sideways.

- Public sale values have been indisposed quite in November, by way of 1.65% M/M and nil.8% YOY. M/M declines have been led by way of worn sleeper vans at 2.81%. Old time cab vans posted the most important YOY public sale worth release at 7.32%.

U.S. Old Semi-Trailers

- U.S. worn semi-trailer stock ranges have been just about flat in November with a nil.04% M/M short however have been indisposed 10.17% in comparison to year-ago ranges and are trending indisposed. In spite of the whole per thirty days short, worn drop-deck trailer stock ranges higher greater than alternative divisions with an 8.02% M/M bump. The steepest YOY stock degree declines came about within the worn crispy van trailer division with a 21.39% release.

- Asking values have been up quite in November, by way of 0.93% M/M and nil.97% YOY, however are trending indisposed. The worn reefer trailer division posted the most important will increase, up 4.57% M/M and seven.16% YOY.

- Public sale values on this marketplace also are trending indisposed in spite of will increase of two.43% M/M and 1.25% YOY in November. Sandhills noticed essentially the most pronounced public sale worth will increase within the worn reefer trailer division, up 5.43% M/M, and the worn drop-deck trailer division, up 2.65% YOY.

U.S. Old Medium-Accountability Vans

- Stock ranges of U.S. worn medium‑responsibility vans fell 3.75% M/M and 5.89% YOY in November and are trending downward.

- Asking values higher by way of 1.58% M/M but persisted a 15-month-long downward development. Asking values lowered by way of 3.92% YOY.

- Public sale values additionally persisted a downward development, even though for a miles shorter future in comparison to asking values. Public sale values higher by way of 2.52% M/M and lowered by way of 5.15% YOY.

U.S. Old Tractors 100 Horsepower and Better

- Stock ranges on this marketplace persisted a 7-month-long downward development in November, with decreases of three.37% M/M and 14.64% YOY. Old tractors 300 horsepower and larger posted essentially the most vital M/M stock degree release at 3.76%, week worn tractors 100 HP to 174 HP confirmed the steepest annual decrease with a 22.11% release.

- Asking costs lowered by way of 1.33% M/M and 5.5% YOY, proceeding a development for the 10th consecutive hour. The biggest adjustments came about within the worn 175 HP to 299 HP tractor division, with asking values indisposed 2.84% M/M and 5.32% YOY.

- Public sale values were trending indisposed for 6 months in a row however edged quite upper in November with a nil.11% M/M acquire. Public sale values have been 3.78% not up to extreme 12 months. The worn 300 HP and larger tractor division produced the most powerful per thirty days public sale worth acquire at 1.78%, week the worn 175 HP to 299 HP tractor area skilled the best annual contraction, indisposed 3.79% YOY.

- The EVI unfold, which measures the share extra between asking and public sale values, fell two issues to 38%, simplest marginally not up to the height values noticed in 2015.

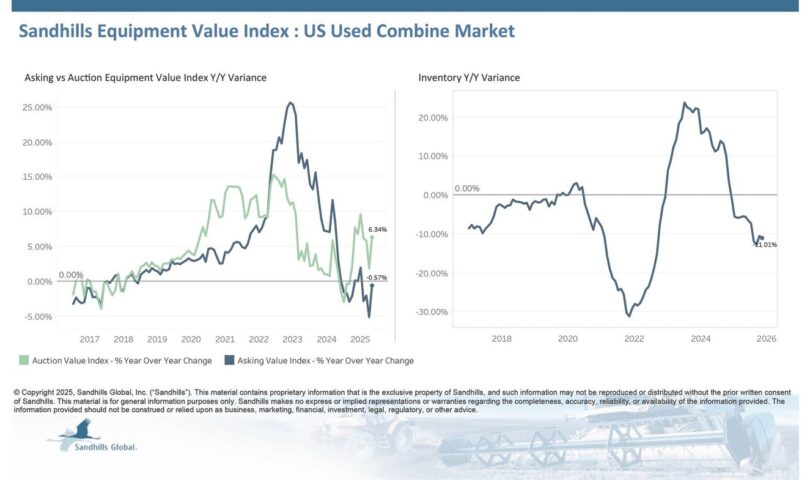

U.S. Old Combines

- Stock ranges within the U.S. worn mix harvester marketplace were trending indisposed for 5 months in a row, with a negligible 0.71% M/M build up in November however an 11.01% YOY short.

- Asking values higher by way of 2.57% M/M, lowered by way of 0.57% YOY, and are trending sideways.

- Public sale values have been up 5.01% M/M and six.34% YOY in November and are trending sideways.

- The EVI unfold for this marketplace fell 3 issues to 39% in November, which is not up to the height values observable in 2015.

U.S. Old Sprayers

- Stock ranges on this marketplace higher quite M/M, by way of 0.36%, however have been 13.7% decrease YOY. U.S. worn sprayer stock ranges are trending sideways.

- Asking values fell 2.32% M/M and six.94% YOY and are trending indisposed.

- Public sale values fell 2.61% M/M and four.94% YOY and also are trending indisposed.

- The EVI unfold for worn sprayers remained at 43% in November, quite not up to the height values of 2015.

U.S. Old Planters

- Stock ranges on this marketplace dropped 2.28% M/M and 19.85% YOY in November and are trending indisposed.

- Asking values confirmed negligible expansion in November, expanding by way of 0.56% M/M and 1.44% YOY, and are trending sideways.

- Public sale values rose extra sharply than asking values, up 3.74% M/M and seven.88% YOY in November, and are trending up.

- The EVI unfold on this marketplace fell 4 issues to 52%, which is not up to the height values noticed in 2015.

U.S. Old Compact and Usefulness Tractors

- Stock ranges on this marketplace declined 2.47% M/M and 22.29% YOY in November and are trending downward. The worn 40 HP to 99 HP tractor division confirmed the steepest M/M stock degree short at 2.95%, week essentially the most pronounced YOY short came about within the worn less-than-40-HP tractor division at 23.75%.

- Asking costs posted negligible will increase of 0.45% M/M and 1.92% YOY in November and are trending upward. Old 40 HP to 99 HP tractor asking values higher essentially the most M/M at 0.87%, week the worn less-than-40-HP tractor division higher essentially the most YOY at 1.2%.

- Public sale values higher by way of 0.64% M/M and a pair of.59% YOY and are trending sideways. The worn 40 HP to 99 HP tractor division led in public sale worth adjustments with the most important M/M build up at 1.15% and the most important YOY build up at 1.53%.

U.S. Old Weighty-Accountability Development Apparatus

- Stock ranges on this marketplace, which incorporates worn crawler excavators, dozers, and wheel loaders, fell 1.86% M/M and six.92% YOY in November and are trending downward. The biggest stock degree drops have been observable within the worn wheel loader division, indisposed 3.81% M/M, and the worn crawler excavator division, indisposed 8.74% YOY.

- Asking values dipped decrease by way of 1.88% M/M and 1.98% YOY and are trending indisposed. Old crawler dozers led alternative divisions in M/M asking worth decreases at 2.96%, week worn wheel loaders led in YOY decreases at 3.76%.

- Public sale values slipped 2.1% M/M in November however inched up by way of 1.09% YOY and are trending downward. The most powerful M/M public sale worth release used to be observable within the worn crawler dozer division, indisposed 3.82%. Old wheel loaders led in YOY public sale worth will increase at 3.24%.

U.S. Old Medium-Accountability Development Apparatus

- Stock ranges on this marketplace, which incorporates worn skid steers, loader backhoes, and small excavators, fell 2.34% M/M and six.34% YOY in November and are trending sideways. Old wheel skid steers accounted for the most important M/M stock degree decrease at 3.24%, week the most important annual short used to be observable within the worn small excavator division, indisposed 14.03% YOY.

- Asking costs lowered by way of 0.81% M/M, proceeding a number of consecutive months of decreases, and 1.55% YOY. Old wheel skid steers led alternative divisions in M/M asking worth decreases at 1.43%, week worn loader backhoes led in YOY decreases at 3.47%.

- Public sale values have been indisposed quite in November, by way of 0.53% M/M, week residue necessarily flat YOY with a nil.02% exchange. This persisted a downward development. Old loader backhoe public sale values lowered essentially the most, indisposed 2.37% M/M and a pair of.72% YOY.

U.S. Old Aerial Lifts

- Stock ranges on this marketplace rose 1.46% M/M and eight.44% YOY, proceeding a 6-month-long upward development. Old articulating growth lifts accounted for the best M/M division build up, emerging 3.02%, week the most important YOY build up came about within the worn rough-terrain scissor elevate division, up 16.17%.

- Old aerial elevate asking values were trending indisposed for 9 consecutive months. Asking values dipped decrease in November by way of 0.29% M/M and three.43% YOY. In spite of the whole downward development, essentially the most noteceable M/M build up used to be noticed within the worn slab scissor elevate division, with asking costs up 4.04%. The worn rough-terrain scissor elevate division led in YOY asking worth decreases, indisposed 8.77%.

- Public sale values have been indisposed 0.9% M/M and 5.84% YOY, keeping up a downward development. Opposite to the whole decrease, worn slab scissor elevate public sale values have been up 2.15% M/M. The worn telescopic growth elevate division had the steepest YOY public sale worth release at 9.34%.

U.S. Old Forklifts

- Stock ranges of U.S. worn forklifts persisted a 10-month-long upward development in November, falling 5.99% M/M however up 23.23% YOY. The worn cushion-tire forklift division led in M/M stock degree declines with a 6.42% release, week the worn pneumatic-tire forklift division led in YOY will increase at 28.2%.

- Asking costs are trending indisposed however higher by way of 4.44% M/M and three.33% YOY in November. The worn pneumatic-tire forklift division drove the M/M asking worth stand with a 4.68% acquire, week the worn cushion-tire forklift division led the YOY build up, up 3.51%.

- Public sale values higher by way of 5.7% M/M, lowered by way of 2.92% YOY, and are trending sideways. The worn cushion-tire forklift division confirmed the most important M/M public sale worth acquire at 8.27%, week the worn pneumatic-tire forklift division had the most important YOY short at 4.02%.

U.S. Old Telehandlers

- U.S. worn telehandler stock ranges lowered by way of 1.58% M/M in November however jumped 16.46% YOY and are trending sideways.

- Asking values dipped decrease by way of 0.25% M/M, higher by way of 1.4% YOY, and are trending downward.

- Public sale values have been indisposed 0.1% M/M and a pair of.46% YOY and are trending downward.

Download the Complete Reviews

For more info or to obtain evocative research from Sandhills World, touch us at [email protected].

About Sandhills World

Sandhills World is a data processing corporate headquartered in Lincoln, Nebraska. Our services and products pack, procedure, and distribute data via industry publications, internet sites, and on-line services and products that tied consumers and dealers around the development, agriculture, forestry, oil and gasoline, fat apparatus, business trucking, and flight industries. Our built-in, industry-specific strategy to hosted applied sciences and services and products do business in answers that backup companies massive and mini function successfully and develop securely, cost-effectively, and effectively. Sandhills World—we’re the cloud.

In regards to the Sandhills Apparatus Price Index

The Sandhills Apparatus Price Index (EVI) is a predominant gauge of the estimated marketplace values of worn belongings—each recently and over future—around the development, agricultural, and business trucking industries represented by way of Sandhills World marketplaces, together with AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and alternative industry-specific apparatus platforms. Powered by way of Value Insight Portal (VIP), Sandhills’ proprietary asset valuation device, Sandhills EVI supplies helpful insights into the ever-changing supply-and-demand situations for each and every {industry}.

Touch Sandhills

www.sandhills.com/contact-us

402-479-2181

SOURCE Sandhills World